Pinterest’s soft Q4 report comes after upbeat results from rivals Snap and Reddit.

- Pinterest reported Q4 revenue and profit, and forecast Q1 sales below Wall Street’s expectations.

- Shares dropped over 18% in the after-hours session.

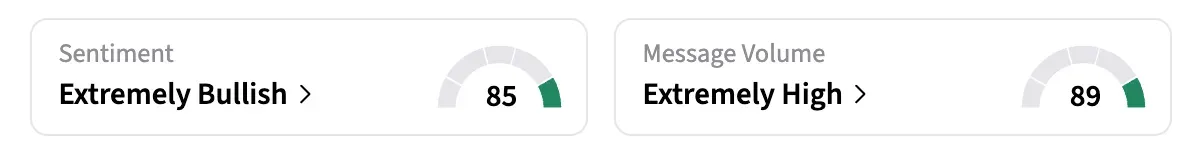

- Stocktwits sentiment for PINS shifted to ‘extremely bullish’ from ‘bearish’ territory as some users saw the selloff as overdone and Pinterest potentially emerging as an attractive acquisition target.

Pinterest, Inc. (PINS) shares plunged by over 18% in the extended trading session on Thursday after its first-quarter revenue forecast came in below Wall Street’s expectations, fanning long-time worries that it is losing advertisers to larger platforms like Meta’s Instagram and Snapchat.

The image board platform also reported lower-than-expected holiday quarter sales and profit.

The plunge comes amid a sharp drop in recent weeks – Pinterest shares were already down about 28% in the new year, as of the last close – and is reminiscent of the selloff after its third-quarter (Q3) report in November, when the stock dropped nearly 22% in a single day.

Last month, Pinterest said it would lay off under 15% of its workforce and reduce its office space as part of a broad restructuring to divert resources to artificial intelligence (AI). The cuts are meant to support “transformation initiatives,” including AI-focused roles and AI-powered products, the company said at the time.

Pinterest Acquisition?

On Stocktwits, retail sentiment for PINS shifted to ‘extremely bullish’ territory as of late Thursday, from the ‘bearish’ zone the previous day.

“Buying more. Not even worried. Opportunity here. May take a few months, but I can wait,” said one user.

“In terms of the actual results, objectively they really were just not that bad… Bigger picture, they need to fire the CEO and cut a deal with OpenAI,” another user said.

Members also discussed how Pinterest had become an attractive acquisition target. ”At these prices it's an acquisition target, esp for OpenAI,” a user said, amid comments speculating that Meta Platforms (META), Google (GOOG/GOOGL), and even Walmart (WMT)could be interested in buying the company.

Earnings, Forecast

Pinterest reported fourth-quarter revenue of $1.32 billion and adjusted profit of $0.56 per share – both came in below analysts’ expectations of $1.33 billion in revenue and $0.67 per share profit as per Koyfin.

For the first quarter, the company expects revenue to be in the range of $951 million to $971 million, below the analysts' average estimate of $980.6 million.

Pinterest’s report pales in comparison to the upbeat results from rivals Snap and Reddit, both of which posted meaningful business gains fueled by AI features rolled out over the past year. These companies are AI partnerships with Perplexity AI and OpenAI, respectively.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<