The company’s Q1 loss is expected to narrow significantly, with a 31% jump in revenues, according to estimates.

One97 Communications (Paytm) is expected to report an improvement in its June quarter (Q1 FY26) earnings on Tuesday.

According to reports, Paytm’s adjusted net loss is expected to narrow significantly to ₹126.63 crore in Q1FY26 from ₹838.9 crore a year ago, while revenue is expected to grow 31% to ₹1,968.15 crore.

Paytm’s stock is showing signs of a potential breakout ahead of its results, said SEBI-registered analyst Rohit Mehta.

The stock is currently forming a bullish cup and handle pattern near the key resistance zone of ₹1,053, and a sustained move above this level could open the door to further upside, he added.

With support in the ₹446 - ₹518 range, all eyes are on earnings to trigger directional momentum.

The shares ended nearly 2% higher at 1,020.50 on Monday.

The consolidation near resistance suggests strength, but confirmation is needed with volume and price action. The all-time high at ₹1,955.75 remains a long-term target, but near-term movement will depend heavily on the upcoming financial performance, Mehta said.

On the fundamental front, it’s a mixed bag. While Paytm remains virtually debt-free and has a strong 10-year median sales growth of 24.9%, it struggles with negative returns. Its ROE stands at -10.8% over the past three years.

The company trades at 4.25x its book value, reflecting elevated valuations. Foreign investors holding (FII) declined slightly to 54.87% in June 2025, while DIIs (domestic investors) increased their stake to 15.84%.

If Q1 FY26 shows further operational improvement, it may provide the catalyst that bulls have been waiting for. Until then, traders should keep an eye on the ₹1,053 level for signs of a breakout, he concluded.

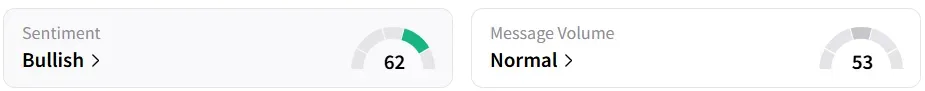

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ last week.

Year-to-date (YTD), the shares have gained a marginal 0.34%.

For updates and corrections, email newsroom[at]stocktwits[dot]com<