The company said its pharma patient affordability revenue more than doubled to $2.63 million.

Paysign (PAYS) stock rose 3.2% in extended trading on Tuesday after the company’s fourth-quarter revenue and 2025 forecast topped Wall Street’s expectations.

According to FinChat data, the healthcare-focused financial services firm posted quarterly revenue of $15.61 million, compared with Wall Street’s estimates of $15.42 million.

Paysign reported net earnings of $1.37 million, or $0.02 per share, for the fourth quarter, compared with a net income of $5.62 million, or $0.10 per share a year earlier, when it got a one-time benefit of $4.59 million from the release of its valuation allowance for federal and state deferred tax assets.

The company said that its pharma patient affordability revenue more than doubled to $2.63 million, aided by the launch of new patient affordability programs.

However, its plasma revenue declined by 6.2% to $717,000, hurt by a decrease in plasma donations and dollars loaded to cards as plasma inventory levels have normalized.

The company said it exited the quarter with about 7.3 million cardholders and approximately 600 card programs.

“As we have started to experience a near-term slowdown in our plasma business due to an industry-wide oversupply of plasma, we will continue to utilize the cash flow from this business to invest in our patient affordability business,” said Chief Financial Officer Jeff Baker.

The company had said earlier on Tuesday that it has bought the assets of Gamma Innovation to boost Paysign’s capabilities in plasma donor and pharmaceutical patient engagement technologies.

The company projected its total 2025 revenue to be between $68.5 million and $70 million, while Wall Street expects it to post $65.9 million in revenue.

Paysign said it expects annual net income to be about break-even this year.

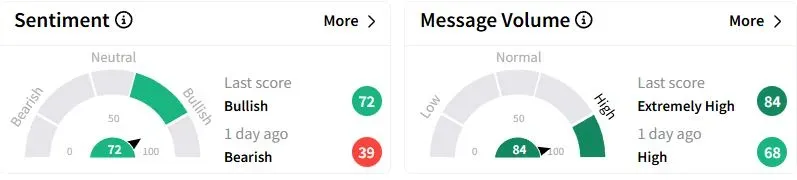

Retail sentiment on Stocktwits jumped to ‘bullish’ (72/100) territory from ‘bearish’(39/100) a day ago, while retail chatter rose to ‘extremely high.’

Retail traders felt the company’s earnings were strong and expected a more substantial move in Wednesday’s trading session.

Paysign shares have fallen 17.9% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<