Wedbush raised Palantir's price target, citing strong AI adoption, federal momentum, and a potential of over $1 billion in commercial revenue.

Wedbush Securities analyst Daniel Ives raised the price target for Palantir Technologies Inc. (PLTR) to $160 from $140 and reiterated an "outperform" rating on the shares, citing growing optimism around the company’s expanding artificial intelligence (AI) portfolio and increasing enterprise adoption.

Palantir stock inched 0.2% higher in Thursday’s premarket.

The analyst highlighted Palantir’s trajectory toward becoming a strong player in the evolving AI ecosystem, citing the brokerage’s recent field checks and surging customer demand. “We believe Palantir has a golden path to become an AI stalwart in the next few years,” Ives said in a post on X.

The research firm said Palantir has a “clear runway to emerge as the next Oracle,” as it continues to scale AI-driven solutions for both public and private sectors.

It estimates that Palantir’s U.S. commercial AI business alone could generate over $1 billion in annual revenue within the next several years.

Wedbush’s recent checks suggest commercial and government entities are adopting the Artificial Intelligence Platform (AIP) suite to streamline operations and unlock AI use cases at scale.

From deploying machine learning workflows to creating operational efficiencies, organizations are reportedly finding Palantir's offerings indispensable.

According to Ives, the company’s AI bootcamps are becoming a key conversion tool, reducing sales cycles and pushing rapid product deployments.

With rising demand from the U.S. government, Palantir is expected to benefit from increased AI spending under the current administration.

Ives noted that initiatives like Project Stargate and growing Department of Defense investment are likely to boost Palantir’s federal revenue streams.

A recent contract with NATO adds another layer of momentum, with the analyst anticipating growth in U.S., European, and Middle Eastern government markets.

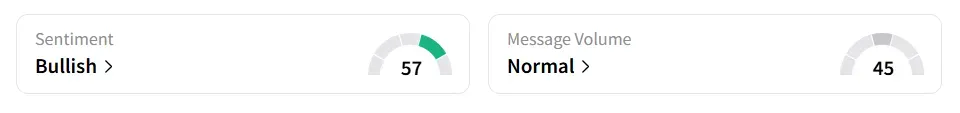

On Stocktwits, retail sentiment toward Palantir improved to ‘bullish’ from ‘neutral’ territory amid ‘normal’ message volume levels.

Palantir stock has gained over 89% year-to-date and over fivefold in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<