Opendoor has had a strong start to the new year.

- Opendoor stock plunged over 11% on Wednesday, along with other housing-related stocks, after President Donald Trump signaled a new rule to ban institutional ownership of single-family homes.

- Trump said he is working to implement the plan into law.

- Retail investors turned upbeat on Opendoor, with some Stocktwits members and Opendoor management arguing that the plan would not affect the company.

Opendoor Technologies’ stock drew intense buzz on Stocktwits late Wednesday after President Donald Trump’s proposal to bar large institutional investors from buying single-family homes weighed on the company and other housing-related stocks.

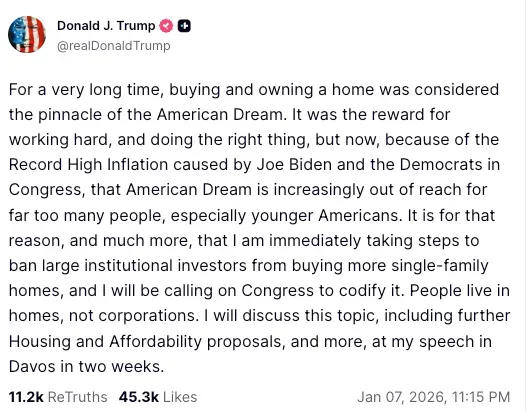

Trump’s Plan

“I am immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it. People live in homes, not corporations,” Trump said in a Truth Social post, arguing that corporate ownership has pushed housing further out of reach for everyday Americans.

To be sure, private equity firms and real estate trusts own sizable portfolios of single-family homes, a trend many argue has driven up prices and squeezed supply for would-be homeowners.

Opendoor CEO Kaz Nejatian posted in support of Trump’s proposal on X, and while President Lucas Matheson clarified that the company is indeed not an “institutional buyer.”

Housing-Related Stocks Plummet

On Wednesday, Opendoor stock dropped 11.7%, while shares of Blackstone and Apollo Global Management – investment firms with substantial real estate holdings – declined about 5.5%. Home builders suffered too, with the stocks of D.R. Horton, Lennar Corp., and PulteGroup ending between 2.3% and 3.6% lower.

Upbeat Expectations From OPEN

Notwithstanding the dip, Opendoor investors on Stocktwits were deeply divided, with many arguing that this news is fundamentally bullish for Opendoor's model as it primarily facilitates home transactions for individual buyers rather than acting as a long-term institutional landlord. Opendoor’s stock recovered in the after-market session, gaining nearly 3%.

Stocktwits sentiment for OPEN climbed multiple points higher in the ‘extremely bullish’ (92/100) zone, with message volume for the ticker surging 120% in the past 24 hours.

Most users expect a sharp rise in stock on Thursday, with one saying, “misunderstood news is the best most violent reversal pattern tomorrow and this afternoon and by Friday we should see $10+.”

Retail investors have turned upbeat about OPEN’s stock, which has rebounded over the past few days after a lackluster fourth quarter. A recent Stocktwits poll showed that the highest percentage of voters expect the stock to hit $10 – that’s over 60% above the last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<