The company’s Optimus drone has received Blue List recognition from the Defense Contract Management Agency (DCMA).

- The DCMA Blue List identifies commercial drones that satisfy rigorous requirements for cybersecurity, supply-chain integrity, and operational reliability.

- Central to the Optimus drone’s operation is a drone-in-a-box dock capable of 24/7 operations.

- The system can automatically swap payloads using an integrated mechanical arm, allowing it to switch mission types.

Ondas Inc. (ONDS) announced on Wednesday that its Optimus drone has earned Blue List recognition from the Defense Contract Management Agency (DCMA).

The move confirms that the drone, developed through Ondas’ subsidiary American Robotics, meets strict Department of War (DoW) standards for secure unmanned aerial systems.

Operational Readiness

The DCMA Blue List identifies commercial drones that satisfy rigorous requirements for cybersecurity, supply-chain integrity, and operational reliability. Inclusion enables government and defense agencies to shorten contracting timelines and deploy the platform quickly for national security and critical infrastructure missions.

"It validates the Optimus drone as a secure, reliable, and operationally proven platform for defense use.”

-Eric Brock, Chairman and CEO, Ondas

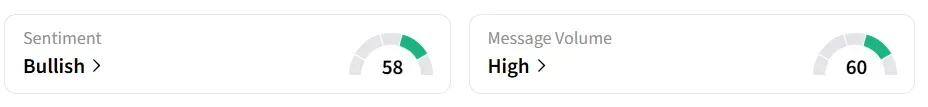

Following the update, Ondas stock traded over 5% higher on Wednesday morning. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

Autonomous Flight Capabilities

Central to the Optimus drone’s operation is a drone-in-a-box dock capable of 24/7 operations, housing 11 batteries and up to nine mission payloads. The system can automatically swap payloads using an integrated mechanical arm, allowing it to switch mission types without human intervention while maintaining continuous aerial coverage.

Ondas highlighted that Blue List approval positions its technology for broader adoption across both defense and commercial critical infrastructure sectors. On January 16, the company increased its revenue forecast for fiscal year 2026 to the $170 million to $180 million, 25% higher than its previous forecast of $140 million.

For 2025, the company expects a backlog of $65.3 million, which is an increase of 180% from the $23.3 million estimate provided in November.

ONDS stock has gained over 608% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<