NVDA rebounds nearly 1% in premarket after an almost 3% drop the previous day.

- Multiple reports have raised concerns about Nvidia’s $100 billion investment-cum-computing deal with OpenAI, announced in September.

- The companies have denied the reports; OpenAI’s CEO Sam Altman praised Nvidia’s chips, while Nvidia CEO Jensen Huang said his company is proceeding with one of the largest investments.

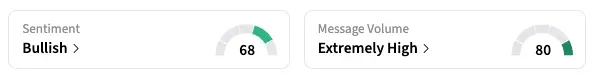

- Stocktwits sentiment for Nvidia shifted to ‘bearish’ from ‘neutral.’

Nvidia’s stock gained 0.8% in early premarket trading on Tuesday, although its Stocktwits sentiment shifted to ‘bearish’ from ‘neutral,’ amid uncertainty over the chipmaker’s investment-cum-computing deal with OpenAI.

The issue has generated significant buzz and market reaction in the past few days. At the center is a September agreement under which Nvidia agreed to invest up to $100 billion in OpenAI and to build and support cloud data centers. That’s now reportedly stalled, and Nvidia is instead considering investing in OpenAI’s equity round that is currently in the works.

Nvidia’s shares ended nearly 3% lower on Monday.

The Wall Street Journal, which first reported that the deal was put on ice on Saturday, reported that Nvidia CEO privately criticized what he has described as a lack of discipline in OpenAI’s business approach and expressed concern about the competition it faces from the likes of Google and Anthropic.

Interestingly, Reuters reported late Monday that OpenAI has been unsatisfied with some of Nvidia’s latest artificial intelligence chips, and has sought alternatives for a year. The news agency cited eight unnamed sources for that information.

Simultaneously, OpenAI CEO Sam Altman moved to allay fears, posting on X on Monday: “We love working with NVIDIA and they make the best AI chips in the world. We hope to be a gigantic customer for a very long time.”

He referred to reports of the rift between the two companies as “insanity.”

OpenAI’s computing infrastructure leader, Sachin Katti, also posted on X, saying that Nvidia’s technology is “foundational” for OpenAI. “This is not a vendor relationship. It is deep, ongoing co-design,” he said, adding that OpenAI’s compute capacity would accelerate steadily from roughly 1.9 GW in 2025.

The developments are being closely monitored. OpenAI – with cloud contracts with the biggest players like Google, Amazon, Nvidia, and Oracle – has become the centerpiece of Big Tech’s stock momentum.

Some investors and analysts have expressed concerns about whether its revenue growth will meet the lofty capital investment targets, including payouts to cloud service providers, that it has set for itself. Those concerns have come to hit at least Oracle.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<