The talks underscore Nvidia’s effort to deepen its AI platform as competition for talent and scale intensifies.

- AI21 Labs brings generative AI and enterprise large language models (LLM) expertise.

- The talks align with Nvidia’s broader push beyond chips into software, inference, and AI stack control.

- The reported deal comes amid a surge in large AI transactions as companies race to secure talent and infrastructure.

Nvidia is supposedly in advanced discussions to acquire Israel-based AI startup AI21 Labs for roughly $2 billion to $3 billion.

AI21 was last valued at $1.4 billion in 2023, when Nvidia and Alphabet’s Google participated in a funding round, according to a Reuters report, citing the Calcalist.

Why AI21 Matters

Founded in 2017 by Amnon Shashua and two others, AI21 has built a large language model (LLM) and generative AI capabilities amid rapid growth in enterprise and foundation-model development. Shashua is also the founder and CEO of Mobileye.

AI21 has reportedly been open to a sale for some time, with talks accelerating in recent weeks. Nvidia’s primary interest appears to be AI21’s roughly 200-person workforce, many of whom hold advanced academic degrees and have deep expertise in AI research and model development.

Nvidia’s Israel Expansion

The reported talks come as Nvidia plans a significant expansion in Israel, including a new research and development campus in Kiryat Tivon, south of Haifa. Nvidia has said the site could eventually employ up to 10,000 people and span 160,000 square meters across 90 dunams.

CEO Jensen Huang has previously described Israel as Nvidia’s “second home.” Construction is expected to begin in 2027, with initial occupancy targeted for 2031.

AI Deal-Making Momentum

The potential AI21 acquisition comes amid a broader wave of large-scale AI dealmaking. Earlier this week, SoftBank Group agreed to acquire digital infrastructure investor DigitalBridge Group for about $4 billion, underscoring rising competition to secure the compute, data center, and connectivity assets needed to scale AI.

For Nvidia, the talks would add to its push beyond chips into AI software, talent, and infrastructure. Last week, the company entered a non-exclusive licensing agreement with Groq for inference technology, which CNBC reported could be worth around $20 billion.

Analysts at Citi, Truist, Stifel, and UBS have recently reiterated ‘Buy’ ratings on Nvidia, citing its cash position, earnings momentum, and expanding role across both AI training and inference.

How Did Stocktwits Users React?

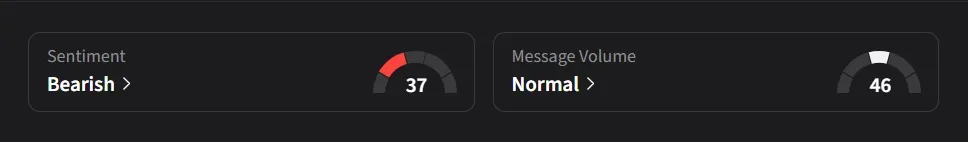

On Stocktwits, retail sentiment for Nvidia was ‘bearish’ amid ‘normal’ message volume.

One bullish user said Nvidia’s edge lies in broad multi-cloud and on-prem reach versus Google’s tensor processing units (TPUs), adding that Groq boosts inference efficiency, AI21 strengthens the AI stack and graphics processing unit (GPU) demand, and Nvidia’s cash allows faster execution alongside buybacks.

Meanwhile, a bearish user questioned the enthusiasm around Nvidia’s spending on Groq, arguing that competing technologies still lead on speed and efficiency, and suggesting the market may be paying a premium to sustain a narrative about AI leadership rather than rewarding performance.

Nvidia’s stock has risen 40% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<