The analyst expects a higher probability of correction in the Nifty index and urges caution. Key levels to watch are 24,230 on the downside and 24,300–24,420 on the upside.

Indian markets are expected to open on a weak note on Friday amid escalating tensions between India and Pakistan.

Nifty futures indicate a gap-down opening for Indian markets, while the India Volatility Index (VIX), a key gauge of market fear, surged over 10% on Thursday, reflecting heightened uncertainty.

Late Thursday night, reports suggested that Indian air defense systems intercepted several Pakistani missiles targeting key border areas.

Additionally, at least 45 hostile drones attempting to penetrate Indian airspace were successfully neutralized. These incidents occurred across a wide area, from Ladakh in the north to Bhuj in the west.

This escalation follows India's recent precision strikes, codenamed “Operation Sindoor,” on terror infrastructure within Pakistan and Pakistan-occupied Kashmir.

Amidst these rising cross-border tensions, the Indian Armed Forces are maintaining a state of high alert.

While the situation is still evolving, geopolitical uncertainty is likely to continue to weigh on investor sentiment.

SEBI-registered analyst Bharat Sharma believes that the Nifty index currently faces a higher probability of further correction, though he acknowledges that market movements cannot be predicted with complete certainty.

As a result, he advocates for maintaining a cautious approach.

Should the decline persist, Sharma identifies the 24,000 mark as a significant psychological support level, with a broader demand zone situated between 23,800 and 24,000.

Immediate support is noted at 24,230, a level that has previously acted as a trough on multiple occasions.

On the upside, immediate resistance is expected around 24,300. If the index manages to breach and sustain above this resistance, it may attempt to decisively overcome the 24,400–24,420 range.

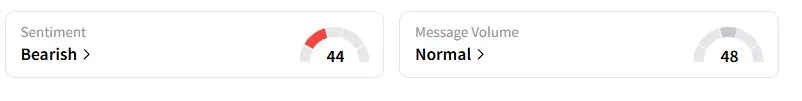

Data on Stocktwits shows that retail sentiment has flipped to ‘bearish’ early on Friday.

The Nifty index has gained 3% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<