Nifty Bank has rebounded sharply from its March lows, gaining over 10% in last one month

India's Nifty Bank index surged to a new all-time high in Monday's opening trade, crossing the 55,000 mark for the first time and reaching as high as 55,256 by 10 am.

The Nifty Bank Index has surged 10% over the past month, rebounding sharply from its March 11 low of 47,853, driven by RBI's policy moves and recent rate cuts by major banks on fixed deposits and savings accounts.

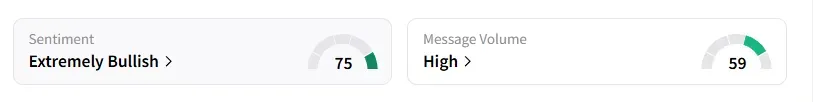

Data from Stocktwits India indicates retail sentiment remains 'Bullish' on the Nifty Bank index, while message volume gained traction a month ago.

This rally also got a boost from robust quarterly earnings from heavyweight constituents ICICI Bank and HDFC Bank.

ICICI Bank shares rose 1%, while HDFC Bank gained around 1.3% in early trading, leading to a broader market uptick.

ICICI Bank reported an 18% year-on-year (YoY) increase in standalone net profit for the January-March quarter, reaching ₹12,630 crore.

The private lender's net interest income rose 11% to ₹21,193 crore, with a net interest margin of 4.32%. Asset quality improved as the gross non-performing assets ratio declined to 1.67% from 1.96% in the previous quarter.

HDFC Bank, India's largest private lender, reported a standalone net profit of ₹17,616 crore for the March quarter, marking a 6.7% YoY increase. Net interest income grew by 10% to ₹32,070 crore. Asset quality also improved, with gross non-performing assets falling to 1.33% from 1.42% in the previous quarter.

Brokerage firms, too, have increased their target prices for ICICI Bank and HDFC Bank because of their improved asset quality and rise in deposits.

SEBI-registered analyst A&Y Market Research has pegged the Nifty Bank's intraday resistance at 54,334-54,470 with support at 53,344-53,457.

Another SEBI-registered analyst, Prabhat Mittal, said on Stocktwits India that ICICI Bank stock had formed a parallel channel on its short-term chart, demonstrating stability in a weak market. Additionally, the stock is trading above its key moving averages, and the MACD indicator (a technical tool that helps analyze price trends and momentum) indicates a ‘buy’ signal.

Mittal suggests that traders can consider buying ICICI Bank in the short term within the range of ₹1,400-1,360 with a stop loss of ₹1,335 and a target of ₹1,500-1,520.

For updates and corrections, email newsroom[at]stocktwits[dot]com.