Technical indicators reinforce the positive outlook and suggest further upside as long as momentum holds, the analyst noted

NESCO is on investors’ radar after making a decisive breakout on technical charts and gaining over 11% in the past week.

After consolidating within a pennant pattern, the stock broke out with strength, signaling a continuation of its prior uptrend, said SEBI-registered analyst Mayank Singh Chandel.

A pennant pattern is a short consolidation phase where the stock price moves within narrow trendlines, typically leading to a breakout in the same direction as the preceding trend.

Chandel highlighted that the upward gap formed on June 10 remains unfilled, signaling sustained buying interest and now serving as a strong support area. The stock has been forming a series of higher lows, a bullish structure that suggests consistent demand at increasing price levels.

The breakout has occurred above the stock’s previous all-time high, negating immediate resistance and potentially leading to further gains, he added.

At the time of writing, NESCO shares were up 3.6% at ₹1,130.00.

Aggressive traders could consider entering at current levels, while conservative investors might wait for a slight pullback, he advised.

Monitoring sustained volume will be crucial to validating the breakout, Chandel said, while cautioning that a tight stop-loss should be placed just below the breakout level.

According to reports, Parag Parikh Flexi Cap Fund, India’s largest flexi cap fund by assets under management (AUM), added NESCO to its portfolio in May.

Year-to-date, the stock has gained around 17%.

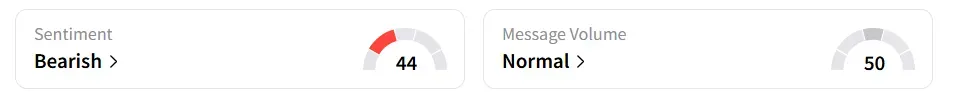

However, retail sentiment on Stocktwits fell to ‘bearish’ from ‘neutral’ a day ago.

The company operates across various segments, including engineering and real estate.

For updates and corrections, email newsroom[at]stocktwits[dot]com.