Micron Technology shares have surged over 189% in the past year amid the rally of dynamic random access memory chips.

- Citi revised MU’s price target to $300, up from $275, and reiterated a ‘Buy’ rating, as per TheFly.

- HSBC and Deutsche Bank also maintained a ‘Buy’ rating on the stock with price targets of $330 and $280, respectively.

- Citi expects the company’s results and outlook to be significantly above consensus estimates in its upcoming quarterly results scheduled for December 17.

Micron Technology (MU) became one of the top-trending tickers on Stocktwits on Wednesday morning following multiple price target hikes on Wall Street.

According to TheFly, Citi raised its target on the memory and storage solutions designer to $300 from $275. The firm reiterated a ‘Buy’ rating on the stock, joining Deutsche Bank and HSBC in their bullish view.

This week, HSBC initiated coverage of MU with a ‘Buy’ rating and $330 price target, while Deutsche Bank raised its target on the stock to $280 from $200 with a ‘Buy’ rating, as per TheFly.

What’s Driving The Price Hikes?

While Citi noted that MU will benefit from the "unprecedented increases" in DRAM (Dynamic Random Access Memory) pricing, HSBC noted that the market is severely underestimating the impact of the DRAM commodity rally while also not factoring in the upside from eSSD market share gain, adding that it believes there is "plenty of room for further growth”.

DRAM is a high-speed working memory deployed in devices like computers and servers to store and process data. It is critical to power the growing demand for AI and surging data center workloads. According to the latest TrendForce report, spot prices of DRAM DDR5 2Gx8 chips soared by over 307% from September to November.

Analysts are focusing on MU ahead of its quarterly report, scheduled for December 17. Citi said in its note that it expects the company’s results and outlook to be significantly above consensus estimates.

How Did Stocktwits Users React?

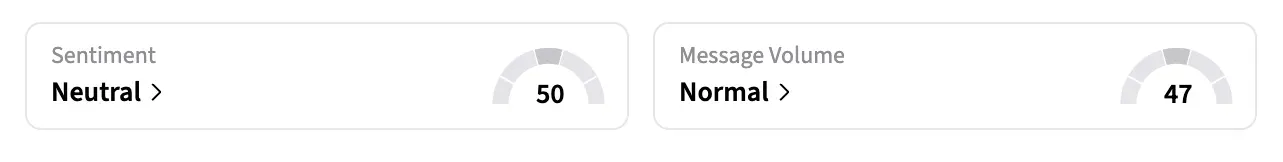

On Stocktwits, retail sentiment around MU jumped from ‘bearish’ to ‘neutral’ territory over the past 24 hours, while message volume remained at ‘normal’ levels.

One user indicated their ‘bullish’ stance on the stock and predicted it could hit $300. MU shares were trading around $253 levels at the time of writing.

Micron Technology shares are up about 0.6% pre-market at the time of writing. Shares of Micron Technology are up over 189% year-to-date and have surged by over 257% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<