Amid inflation, job losses, and tariff-linked price hikes, consumers turned to discount chains — and Dollar General and Dollar Tree made smart tweaks to capture the increased traffic.

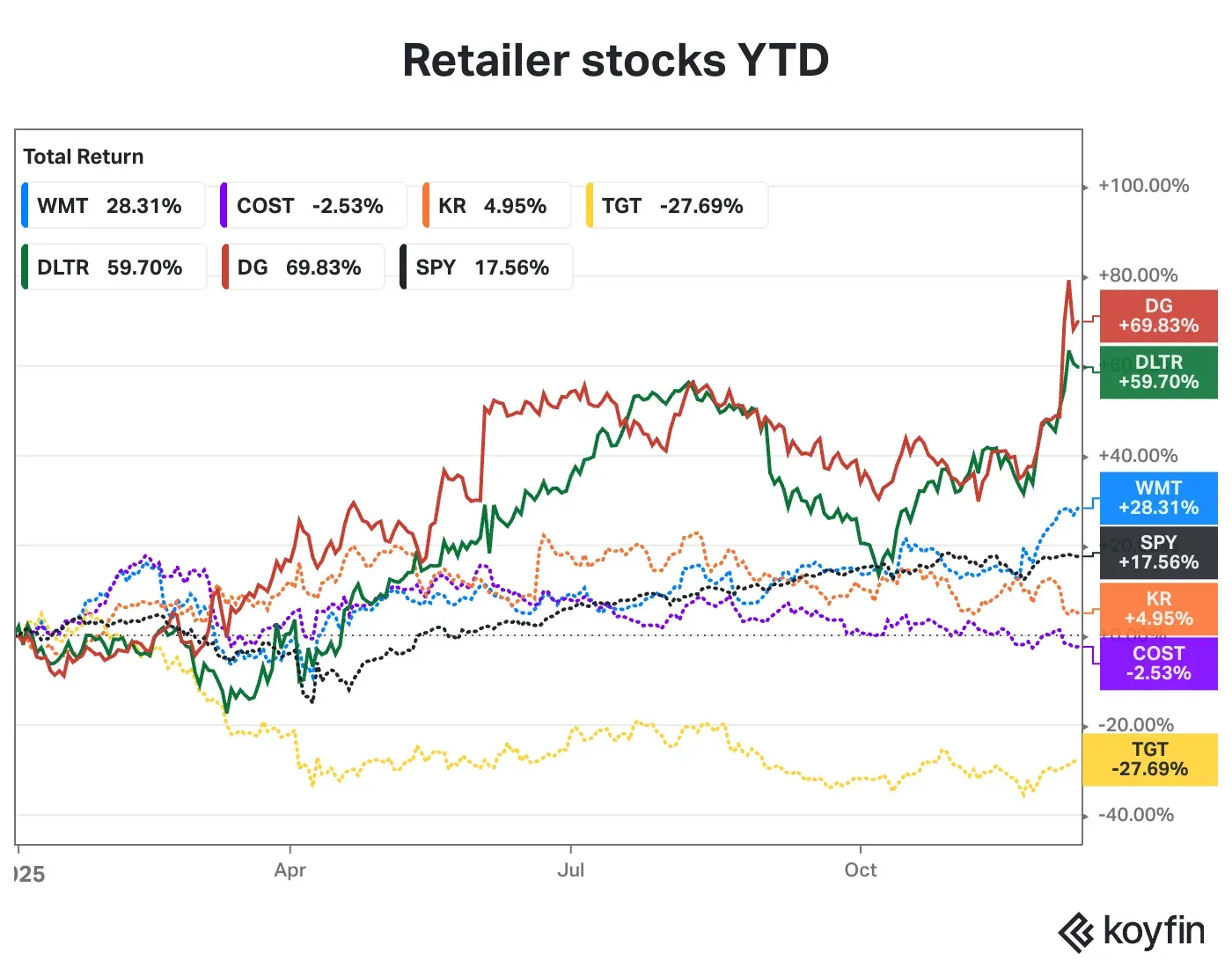

- Stocks of both companies have gained over 60% year-to-date, beating other retailers and defensive stocks.

- Consumers thronged to these discount chains amid high inflation and economic uncertainty for most of the year.

- DG and DLTR have seen a sharp rise in the past week, following their strong results.

President Donald Trump’s tariffs nearly derailed the retail landscape this year, but most chains have managed to steady themselves – with Dollar General and Dollar Tree standing out as the biggest winners.

Amid high inflation, job losses, and tariff-driven price hikes, consumers understandably turned to the discount chains. But that’s not all: both Dollar General (known for low-priced everyday items) and Dollar Tree (known for its everything at $1, now $1.25, range) also made clever tweaks to capitalize on the high customer footfall.

With year-to-date gains of 65.6% and 60%, respectively, DG and DLTR are the top-performing retailer stocks, as well as among the so-called defensive stocks, this year. If one considers the entire retail sector, their gains are only second to Tapestry, which has risen by over 80%.

Smart Moves Driving Earnings

Consequently, both companies raised their annual profit forecast after reporting strong quarterly earnings last week, leading to sharp stock rallies. That momentum, though, has been quietly taking shape over several months.

Dollar General has been on an aggressive store-expansion and remodelling spree, having earlier set a target to open 575 new U.S. stores, fully remodel 2,000 stores, and partially remodel 2,500 stores by the end of 2025.

The company also expanded online deliveries and improved product assortment, emphasizing high-velocity items that drive foot traffic and balancing low-margin staples with higher-margin seasonal goods. The management has routinely cited operational discipline as the driver of Dollar General's gains in a challenging consumer economy.

Dollar Tree, for its part, departed from its rigid “Everything at $1.25” model to adopt three price tiers. The broader price-point strategy allowed it to offer higher-quality or more premium items, expand variety, and thereby raise average transaction values while still marketing “value.”

In August, Dollar Tree launched on Uber Eats, opening up online sales in a big way. The company also vowed to invest in supply chain improvements and technology during its investor day in October.

Retail Landscape Recovers; E-commerce Grows

Retail management commentary in the third quarter broadly suggested that tariff risks were lower than previously feared. Bellwethers Walmart and Costco delivered healthy results, and most retailers have managed to hold fort without making significant price hikes.

That said, trends show that e-commerce adoption continues to eat into physical retailers’ businesses. Stocktwits earlier reported that Amazon is poised to surpass Walmart’s revenue this year for the first time.

Another notable trend: despite expectations that consumers would favor everyday staples, discretionary goods companies actually outperformed when it came to their stocks.

The Consumer Discretionary Select Sector SPDR Fund (XLY) gained 5.1% year-to-date, while the Consumer Staples Select Sector SPDR Fund (XLP) declined 1%. Both underperformed the benchmark S&P 500 index, which rose 16.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<