The analyst warns that the broader trend remains bearish despite the volume-led rally.

Mobikwik (One Mobikwik Systems) shares witnessed a strong rebound on Thursday, rising nearly 10% after plunging 6.4% at the open, triggered by a block deal. The stock has gained nearly 15% from the previous close and around 23% from the day’s low.

According to reports, 8.98% of the equity (worth ₹168 crore) changed hands in a block deal.

SEBI-registered analyst Akhilesh Jat noted that this volatile move drew parallels to the March 2025 rally, when the stock jumped nearly 53% in just three sessions after hitting all-time lows.

Mobikwik stock had listed on Dec 18, 2024, at ₹440, a 58% premium over its ₹279 issue price, and later rallied to ₹698, which is up 150% from the IPO price. However, it has since fallen over 67% from its peak, breaching both listing and issue prices.

Jat highlighted that despite Thursday’s strong move with high volumes, the broader trend remains bearish. He added that unless the stock closes above ₹300 and decisively breaks ₹355 post-consolidation, fresh entries remain risky.

At this stage, Jat advised against initiating fresh positions, as the stock remains in a pronounced downtrend.

Historically, similar sharp upswings have not been sustained. For example, on March 18 and 19, the stock recorded gains of 20% and 19% respectively, marking a 53% rally from the March 17 low of ₹231.10, before resuming its downward trajectory.

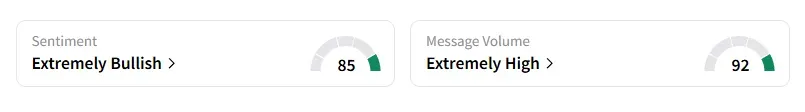

Data on Stocktwits shows that retail sentiment flipped to ‘extremely bullish’ from ‘neutral’ a week ago.

Mobikwik shares have fallen 54% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<