The investor day update comes after a stock collapse last year following mixed Phase 3 VELA trial results that raised concerns about approval risk.

- Investors are seeking clarity on FDA feedback, the regulatory strategy for Sonelokimab, and new clinical data.

- Koyfin data shows a 12-month average price target of $19.71, implying about 7% upside from the stock's last close.

- MoonLake recently received FDA Fast Track designation for Sonelokimab in palmoplantar pustulosis.

Shares of MoonLake Immunotherapeutics, Inc. (MLTX) head into next week’s Investor Day with the event shaping up as the stock’s key catalyst, as investors reassess upside after a turbulent year marked by a clinical setback.

The company will host its Investor Day on Feb. 23, where it is expected to review U.S. Food and Drug Administration (FDA) feedback, its regulatory strategy for Sonelokimab, and new clinical data across multiple indications.

MLTX stock has gained more than 16% over the past three trading sessions, but slid slightly in extended trading on Wednesday.

What The Upside Says Heading Into Investor Day

According to Koyfin data, MoonLake’s 12-month average price target stands at $19.71, implying a 7% upside from the stock's last close.

Analyst targets for the stock span from $6 on the downside to $34 on the upside. From current levels, that translates into a potential downside of roughly 67% or upside of about 84%. Koyfin data also shows nine ‘Buy’ ratings, three ‘Hold’ ratings, and three ‘Sell’

Analysts Split After FDA Meeting

Last month, Goldman Sachs downgraded MoonLake to ‘Sell’ from ‘Neutral’ and set a $10 price target. The firm said that while Sonelokimab’s advancement into Phase 3 for palmoplantar pustulosis offered another opportunity, the failure of the VELA-2 trial to meet its primary endpoint left approval risk in hidradenitis suppurativa high. Goldman added that the FDA’s openness to reviewing a biologics license application did not “materially de-risk” the probability of approval.

Other analysts were more optimistic following MoonLake’s Type B meeting with the FDA in early January. BTIG upgraded the stock to ‘Buy’ with a $24 target, citing regulatory feedback that removed a key overhang by confirming that additional HS trials were not required to establish substantial evidence of effectiveness.

H.C. Wainwright raised its target to $32 while maintaining a ‘Buy’ rating, saying the meeting “delineates” a path toward registration. Clear Street was even more bullish, lifting its target to $45 from $12 after the meeting and keeping a ‘Buy’ rating, saying the existing data could support a “compelling product” label.

FDA Fast Track Clears Path Ahead of Investor Day

Earlier this month, MoonLake announced that the FDA granted Fast Track designation to Sonelokimab for moderate-to-severe palmoplantar pustulosis, following positive Phase 2 LEDA data. The designation enables more frequent FDA interactions and may support an accelerated development pathway.

The company is targeting submission of a biologics license application for Sonelokimab in hidradenitis suppurativa in the second half of 2026, based on data from its MIRA, VELA-1, and VELA-2 trials.

Clinical Miss Sparks Selloff

In September, MoonLake reported week-16 results from its Phase 3 VELA program in hidradenitis suppurativa. While VELA-1 met its endpoints, VELA-2 failed to meet its primary endpoint under the composite analysis, raising concerns about regulatory approval and commercial viability.

The result was a roughly 90% collapse in the stock price over two sessions, falling from roughly $62 to just above $6. The selloff also triggered a securities class-action lawsuit filed in December, alleging that earlier disclosures overstated the drug’s differentiation and regulatory prospects.

How Did Stocktwits Users React?

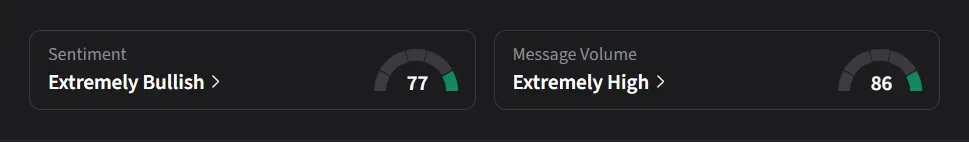

On Stocktwits, retail sentiment for MLTX was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “i can't predict thur and friday but with a $12.50 max pain, there's a chance to buy a dip in the next 2 days. I'm fully loaded but might add if we go under $18.”

Another user said, “No EOD crash last two days so looks good for continuation. Just too excited for Monday right now!”

MLTX stock has risen 40% so far this year, but is still down 57% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<