If pre-market losses hold, then the stock is slated to open below its 200-day moving average for the first time since June 18.

- MIND Technology posted a 30% decline in Q3 revenue to $9.7 million, below Street estimates of $10.9 million.

- Third-quarter EPS came in at $0.01, significantly below the $2.87 per share reported in the same period last year and versus the analysts’ estimate of $0.16.

- CEO Robb Cap said that the company is “positioned for a positive finish to fiscal 2026.”

Shares of MIND Technology Inc. (MIND) slid nearly 25% in premarket trading on Wednesday, and are poised to open below a crucial long-term support level after the company’s third-quarter results fell short of Wall Street expectations.

MIND was among the top trending tickers on Stocktwits. The stock is also on track to open at its lowest levels in over two months, after gaining in eight of the previous nine sessions.

Stock Trades Below Key Long-term Indicator

MIND’s premarket levels indicate a slide that could see the stock open below its 200-day moving average (200-DMA) for the first time since June 18.

MIND reported softer third-quarter results, with revenues declining to $9.7 million from $13.6 million in the prior quarter and $12.1 million a year earlier. This came below analysts’ expectations of $10.9 million, according to Fiscal.ai data.

Operating income also eased to about $774,000, down sharply from $2.7 million in the second quarter. Net income slipped to $62,000, or $0.01 per share, compared with $2.87 per share in the third quarter of fiscal 2025. Analysts had forecast earnings of $0.16 per share.

CEO Rob Capps was upbeat about the company’s fourth-quarter prospects, citing the anticipated delivery schedule for the backlog and recent and expected orders. “We generated positive adjusted EBITDA and positive cash flow from operating activities while raising approximately $11.0 million of cash through our ATM program during the quarter. We believe we are positioned for a positive finish to fiscal 2026 and continue to maintain a clean, debt-free balance sheet with a simplified capital structure as we work to enhance stockholder value,” Capps said.

In September, MIND signed an equity distribution agreement with Lucid Capital Markets, which allowed the company to sell up to $25 million worth of common stock through an at-the-market (ATM) offering.

How Did Stocktwits Users React?

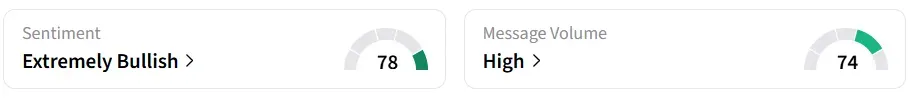

Despite the premarket decline, retail sentiment on Stocktwits flipped to ‘extremely bullish’ from ‘bearish’ a day earlier, accompanied by ‘high’ message volumes.

One user expressed skepticism about the company’s order volumes.

However, another user was bullish about the company’s technology and sees the dip as an opportunity to accumulate.

Year-to-date, the stock has gained 38%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<