The analyst forecasts continued bullish momentum, as the stock has broken out above key resistance levels, triggering buying interest.

Shares of commodity exchange player Multi Commodity Exchange of India (MCX) surged 6% on Wednesday to hit a record high. This comes after global brokerage UBS raised its target price to ₹10,000, indicating 21% upside, driven by strong financials and new product launches.

The regulatory approval for electricity derivatives is expected to unlock fresh hedging tools. MCX reported a 54.2% profit increase in Q4 FY25, beating expectations.

MCX shares have rallied 33% in the last one month.

SEBI-registered analyst Palak Jain predicts further upside potential, with targets set at ₹11,145.34 to ₹12,829.92 in the next three months.

She observed that the stock has broken out above key resistance levels, triggering buying interest. Jain pegged support between ₹8,200-₹8,300, with resistance at ₹9,000-₹9,200.

She concludes that a bullish trend is expected, and investors are advised to monitor the stock closely.

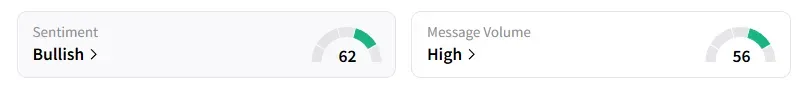

Data on Stocktwits shows that retail sentiment has turned ‘bullish’ on this counter this week.

Year-to-date, MCX shares have gained 38%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<