Lucid depends on the Gravity SUV for near-term volume and is targeting a $50,000 midsize model and a robotaxi program with Uber and Nuro for longer-term growth.

- Investors weighed newly released DOJ documents detailing Jeffrey Epstein’s aborted 2017 investment talks with the EV maker.

- DOJ records show Epstein explored investing in Lucid through parallel channels during a Morgan Stanley-led $400M Series D in 2017.

- Vanguard boosted its Lucid holding for a sixth straight quarter to about 12 million shares.

Shares of Lucid Motors fell marginally in premarket Monday as investors digested newly released Justice Department documents detailing previously undisclosed fundraising discussions tied to Jeffrey Epstein, alongside fresh disclosure that Vanguard Group increased its stake in the EV maker.

LCID stock has slipped about 1% over the past week, closing lower in three of the last five trading sessions. It surged nearly 14% on Friday after Vanguard boosted its stake in the company.

Epstein Files Reveal 2017 Lucid Investment Talks

Newly released DOJ documents show that Jeffrey Epstein pursued a potential investment in Lucid in 2017 through at least two parallel channels, even as the company was conducting an official Series D capital raise led by Morgan Stanley, according to a report by TechCrunch.

Emails reveal that Epstein received detailed terms for a planned $400 million Series D round, with a minimum investment of more than $10 million, and simultaneously reviewed a separate proposal to acquire roughly 30% of Lucid through a secondary share purchase tied to Faraday Future founder Jia Yueting. The discussions ultimately collapsed after Ford declined to serve as a strategic investor, and the Series D did not close.

Epstein reportedly continued to track Lucid into 2018, according to follow-up correspondence that referenced potential Saudi funding. Lucid later secured more than $1 billion from Saudi Arabia’s Public Investment Fund in 2018, which went on to acquire Jia’s shares over subsequent years.

Vanguard Boosts LCID Stake

Meanwhile, Vanguard Group disclosed it increased its Lucid stake for a sixth straight quarter, holding about 12 million shares by the end of 2025 after a 6% increase in the fourth quarter.

Vanguard’s position was valued near $127.5 million at the end of the year before declining alongside Lucid’s share price. The asset manager remains one of Lucid’s largest institutional holders, alongside Saudi Arabia’s Public Investment Fund, which has invested roughly $9 billion in the company since 2018, and Uber, which partnered with Lucid and Nuro on a robotaxi program last year.

Lucid Struggles Persist Despite Growth Plans

Lucid’s shares have struggled in recent years amid production challenges, weak EV demand, and uneven execution, prompting management changes, capital raises, and strategic partnerships.

Last month, the company announced an expanded manufacturing partnership with Rockwell Automation to support its Saudi Arabia facility at King Abdullah Economic City, a site central to its long-term production strategy.

However, Lucid remains heavily dependent on the Lucid Gravity SUV for near-term volume. The model has come under scrutiny after customer complaints re-emerged around software reliability, including navigation errors, sensor warnings, and inconsistent system responses, despite recent over-the-air updates.

Looking ahead, the company has identified growth drivers, including a planned midsize vehicle platform priced around $50,000, targeted for launch in 2026, and its robotaxi program, developed with Uber Technologies and Nuro. The production-intent robotaxi, unveiled at CES 2026, is based on the Gravity platform and is intended for global deployment following validation and testing.

How Did Stocktwits Users React?

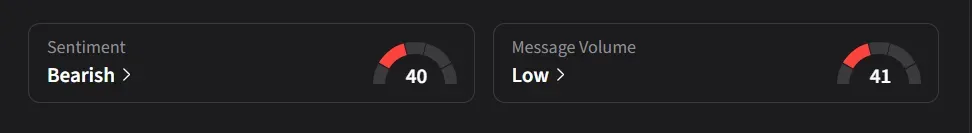

On Stocktwits, retail sentiment for LCID was ‘bearish’ amid ‘low’ message volume.

Lucid’s stock has plunged 62% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<