The update underscored Lucid’s focus on strengthening its long-term production roadmap.

- Lucid shares logged their best session in six months after announcing a deeper manufacturing partnership in Saudi Arabia.

- The collaboration aims to support the scale-up of production for future midsize vehicles.

- The update centers on Lucid’s expanding facility at Saudi Arabia’s first vehicle manufacturing site.

Lucid Group shares posted their best session in six months after the EV maker announced a deeper partnership with Rockwell Automation to support its expanding manufacturing operations in Saudi Arabia, a new pillar of the company’s long-term production strategy.

The stock jumped 18% to close at $11.47 in Wednesday’s session before adding another 0.3% in after-hours trading.

Saudi Manufacturing Expansion

Rockwell said it will support Lucid’s growing manufacturing facility in King Abdullah Economic City (KAEC), a site that marks Saudi Arabia’s first vehicle manufacturing plant. Lucid said the collaboration builds on a long-standing relationship with Rockwell, which previously supported the company’s operations in Arizona.

Under the deal, Lucid will deploy Rockwell’s enterprise software solutions, including its FactoryTalk manufacturing execution system (MES), across all major production areas, including general assembly, paint, stamping, body, and powertrain.

The software is expected to provide real-time visibility, traceability, and operational control, supporting the production of Lucid’s future midsize vehicles. Rockwell added that its local Saudi team will provide both instructor-led and virtual training programs to build EV manufacturing skills among local workers.

Part Of A Broader Growth Push

The Saudi deal comes as Lucid tries to build out its manufacturing presence ahead of its growth into the next stage of production. The company announced at CES 2026 earlier this month that its production-intent robotaxi, alongside Uber Technologies and Nuro. The electric automaker said it has already begun autonomous driving testing on public roads in the San Francisco Bay Area.

The robotaxi is based on the Lucid Gravity platform and uses Nvidia Drive AGX Thor, with production planned at Lucid’s Arizona factory following validation. The partners have said the vehicle is intended for a global robotaxi service, with an initial launch targeted for later this year.

Lucid’s move places it alongside a growing field of autonomous vehicle players, including Tesla, Waymo, Zoox, and Nvidia, as competition in the robotaxi space intensifies.

Execution Remains In Focus

The latest manufacturing update follows a volatile period for Lucid. Last month, the company faced renewed scrutiny after customer complaints resurfaced around software issues in the Gravity SUV, including navigation errors, sensor alerts, and inconsistent system responses. The concerns emerged despite a recent software update, and at a time when Gravity remains central to Lucid’s near-term production and sales mix.

Lucid said Gravity is expected to account for a significant portion of output as it works to stabilize deliveries and improve execution. The automaker has also highlighted longer-term drivers such as its planned midsize vehicle platform, expected to be priced around $50,000, and targeted for launch in 2026.

A Stock Searching For Momentum

Lucid’s shares have struggled in recent years amid production challenges, weak EV demand, and uneven execution, prompting management changes, capital raises, and strategic partnerships.

The company has completed multiple financing rounds, including convertible note offerings and a $500 million investment from Uber tied to the robotaxi program, as it works to shore up liquidity. Analysts have largely remained on the sidelines, with many characterizing Lucid as a “show-me” stock, waiting for clearer signs of sustained production growth and delivery momentum.

How Did Stocktwits Users React?

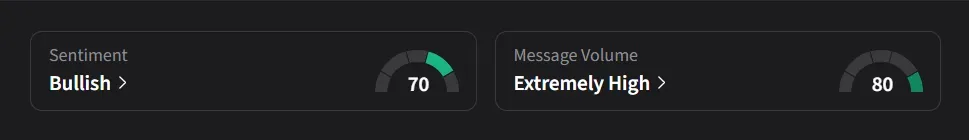

On Stocktwits, retail sentiment for Lucid was ‘bullish’ amid ‘extremely high’ message volume.

One user expects the stock to “cross $50 by [the] end of [the] month.”

Another user said Lucid’s future still rests on its midsize vehicle, stressing the need for scale, strong software, expanded retail and service networks, and deep financial backing to compete effectively in the $50,000 segment.

Lucid’s stock has declined 60% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<