CEO Carlos Abrams-Rivera said the company delivered growth in the international away-from-home channel while the overall U.S. away-from-home industry continues to face pressure due to traffic headwinds.

Kraft Heinz (KHC) CFO Andre Maciel said on Wednesday the company still has pockets of high commodity inflation, particularly on Eastern coffee, and noted that the estimated impact from current levels of U.S. tariffs is about a 100 basis points this year.

“And if the tariffs remain as they are right now, it will create a full-year annualized impact of approximately 180 bps,” Maciel said on a post-earnings call.

Shares of Kraft Heinz were up nearly 1% in early trading after the company beat quarterly revenue expectations, driven by strong demand for its sauces and ketchups.

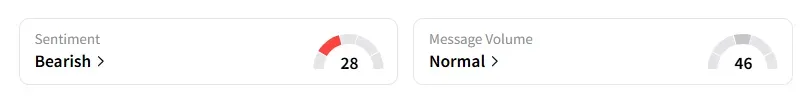

Retail sentiment on the stock remained ‘bearish’ with chatter at ‘normal’ levels, according to Stocktwits data.

Kraft Heinz, like other packaged food makers, has seen a slowdown due to consumers opting for private label brands, which are cheaper than name brands, as they look to save dollars at a time when product prices have broadly increased.

“We recognize that the macro environment remains volatile. Consumers are looking for value – whether that be through price or product benefits,” CEO Carlos Abrams-Rivera said.

Abrams-Rivera added that Kraft Heinz is trying to meet consumer preferences through investments that are driving tangible gains in product appeal and brand leadership.

He noted that the company delivered growth in the international away-from-home channel while the overall U.S. away-from-home industry continues to face pressure due to traffic headwinds.

“Looking ahead, we continue to expect growth in our international business, but we are not contemplating an improvement in the U.S. industry for the rest of 2025,” Abrams-Rivera said.

The company’s net revenue came in at $6.35 billion, compared with analysts' estimates of $6.27 billion, according to data compiled by Fiscal AI. Its adjusted earnings per share of $0.69 topped expectations of $0.64.

Kraft Heinz shares are down 6% year-to-date and have declined over 18% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<