Even as shares slid marginally in Friday’s trade, retail sentiment on Stocktwits remained bullish.

Reliance-owned Jio Financial Services (JFSL) posted solid Q1FY26 results on Thursday, with a topline surge of over 45%.

On a year-on-year basis, consolidated revenue from operations stood at ₹612.46 crore, while profit increased by 4% to ₹324.66 crore.

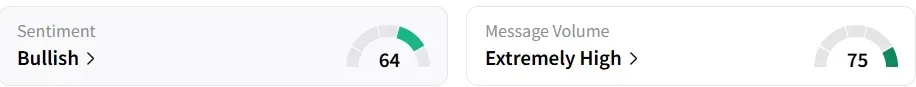

Despite a strong performance, Jio Financial shares traded 0.8% lower at ₹ 316.50 on Friday. However, retail sentiment on Stocktwits was ‘bullish’ amid ‘extremely high’ message volumes.

On the technical charts, JFSL continues to exhibit strength, with the stock currently testing resistance around the ₹340 mark, SEBI-registered analyst Rajneesh Sharma said.

After a breakout from its long-term trendline, the price has successfully retested the structure, reinforcing the bullish setup.

Momentum indicators, such as the relative strength index (RSI), exhibit a positive divergence on the weekly chart, while the formation of higher lows suggests ongoing buying interest.

The key support zone lies between ₹291 and ₹305, and as long as the stock holds above this zone, the overall trend remains upward, Sharma stated.

Supported by strong earnings and a compelling technical structure, JFSL appears well-positioned for a potential breakout if it can decisively clear the ₹340 resistance zone, he added.

CEO Hitesh Sethia emphasized disciplined scaling and a digital-first approach, revealing plans to evolve the JioFinance app into a personalized financial marketplace.

Strategic initiatives like expanding the loan book of Jio Credit, fully acquiring Jio Payments Bank (JPBL) from SBI, and launching Jio BlackRock’s mutual fund with an AUM of more than ₹17,800 crore highlight aggressive yet calibrated growth, the analyst said.

Earlier this month, Jio BlackRock Asset Management, a 50:50 joint venture between Jio Financial Services and US-based BlackRock, raised ₹17,800 crore through the new fund offers (NFOs) across three cash or debt mutual fund schemes.

Year-to-date, the shares have gained over 6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <