As the curtain falls on 2025, U.S. equities are wrapping up a year marked by resilience, volatility, and shifting expectations around interest rates.

- U.S. equity markets are operating on regular business hours, with trading taking place between 9:30 a.m. and 4:00 p.m. ET.

- Investors will have the final opportunity to rebalance their portfolios before the turn of the year.

As investors are set to close the books on another eventful year, many are wondering whether the stock market will be open on December 31.

The answer is yes.

Both the New York Stock Exchange (NYSE) and Nasdaq will be open on Dec. 31, the last trading day of the year. U.S. equity markets are operating on regular business hours, with trading taking place between 9:30 a.m. and 4:00 p.m. ET.

While Dec. 31 falls just ahead of the New Year’s Day holiday, it is not a market holiday for U.S. equities. Investors will have one last opportunity to rebalance portfolios, book tax-related trades, or adjust positioning before the start of 2026. That said, trading volumes on the final day of the year are often lighter than usual, which can occasionally amplify price moves.

How Did US Markets Perform In 2025?

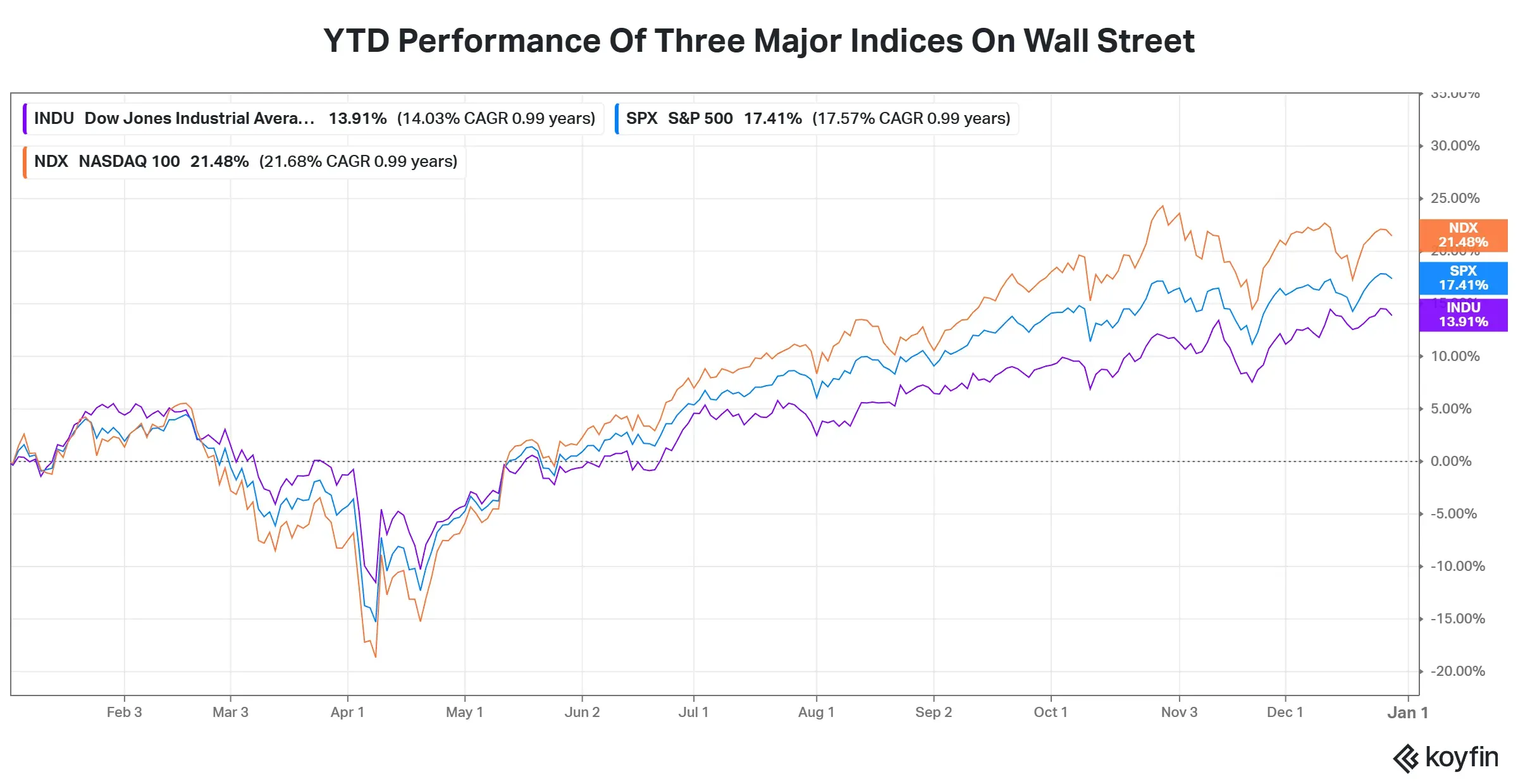

As the curtain falls on 2025, U.S. equities are wrapping up a year marked by resilience, volatility, and shifting expectations around interest rates.

The S&P 500, as tracked by the SPY ETF, delivered strong annual returns, in large part due to robust corporate profits and continued enthusiasm for artificial intelligence. Several megacaps were, of course, significant drivers of index returns, but there were occasional broader-sector inclusions.

The Nasdaq Composite, reflected in the performance of the QQQ ETF, continued to enjoy another strong year, notwithstanding year-end profit-taking in some high-growth tech shares in the latter half of the year. Artificial intelligence-related stocks, semiconductors, and cloud-related shares continue to be top contributors to the year's performance, while valuation concerns surfaced periodically.

On the other hand, the Dow Jones Industrial Average was supported by continued gains in blue-chip stocks, especially those with stable cash flow and strong pricing power. Defensive industries like healthcare and consumer staples acted as a buffer for the index during periods of stock market turbulence.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<