Indian Overseas Bank is gaining strength on the charts. An analyst sees mid-term targets at ₹44–₹49.

Public-sector bank stocks rallied significantly on Monday, including Indian Overseas Bank (IOB), which surged nearly 6%.

SEBI-registered analyst Prameela Balakkala notes that the stock is reacting from a strong demand zone, suggesting institutional accumulation.

IOB currently trades above the 20 Simple Moving Average (SMA), indicating bullish momentum.

The Relative Strength Index (RSI) is rising, confirming increasing strength and potential continuation towards higher resistance levels.

Volume trends also support this bullish outlook, with expanding turnover enhancing its breakout potential.

Balakkala emphasizes that traders must monitor price sustainability above the identified demand zone and trend confirmation near key technical levels for a strong up-move.

She identified a mid-term target at ₹44-45 and ₹49 range with support between ₹37-38.

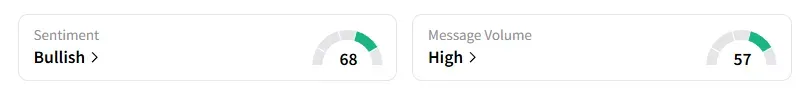

Data on Stocktwits shows retail sentiment is ‘bullish’ amid ‘high’ message volumes.

IOB shares have fallen 18% year-to-date (YTD).

PSU bank stocks rallied on Monday, driven by favourable macroeconomic data on Friday. India's economy grew by 7.4% between January and March, a better-than-expected print showing a significant increase from the previous quarter's 6.2% growth.

All eyes now shift to Friday's Reserve Bank of India’s (RBI) policy meeting verdict. Market expects continued policy support and is pricing in a 25 basis points rate cut on June 6.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<