Analysts, on average, forecast a 40% upside in shares.

- Intuit shares posted their worst drop since August 2024 on Wednesday amid a broad market sell-off.

- INTU has declined for four sessions straight.

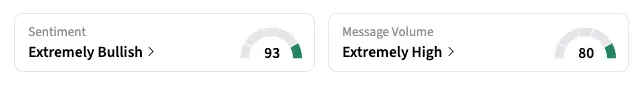

- Stocktwits sentiment reading shifts to ‘extremely bullish,’ with retail investors increasingly viewing the drop as a buying opportunity.

Intuit, Inc.’s stock tumbled 6.4% on Wednesday amid a broad sell-off in U.S. markets, prompting buy calls from Stocktwits users who saw it as a value opportunity.

“$INTU This smells like a tasty opportunity. It may drop some more, but at these levels you're sitting pretty for a nice rebound,” a user posted, while another said, “the reversal has already started,” likely pointing to a modest rebound in the after-hours trading.

The retail sentiment for INTU shifted to ‘extremely bullish’ (93/100) as of late Wednesday, from ‘bullish’ a day ago, with ‘extremely high’ message volume. About 4.8 million shares exchanged hands on Wednesday, nearly three times the stock’s daily average trading volume.

Wednesday’s drop was the largest for Intuit since August 2024. The stock has fallen for four straight sessions – about 13.2% cumulatively – and now sits at its lowest point in nine months.

Stocks across sectors were pressured on Wednesday; The Nasdaq declined 1.1%, while the S&P 500 shed 0.5%, triggered by softer-than-expected results from Wells Fargo and Citigroup.

In November, Intuit reported first-quarter results above market expectations and issued an upbeat forecast, signaling robust demand for its tax and accounting software. It also announced a multi-year deal with OpenAI, worth more than $100 million, to use its AI models for AI agents across its software products.

The AI push is drawing renewed interest in the company, with at least three brokerages – Goldman Sachs, TD Cowen, and Truist – initiating coverage on the stock in recent weeks.

Currently, 25 of 35 analysts rate it ‘Buy’ or higher, nine rate it ‘Hold,’ and one rates it ‘Strong Sell,’ according to Koyfin. Their average price target of $793.05 implies a 40% upside to the stock’s last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<