On an adjusted basis, the company reported earnings of $1.52 per share, compared with the average analysts’ estimate of $1.49 per share.

Intercontinental Exchange Inc (ICE) shares rose 4% to hit record intraday high levels on Thursday afternoon after the company’s fourth-quarter earnings topped Wall Street estimates.

On an adjusted basis, the company reported earnings of $1.52 per share, compared with the average analysts’ estimate of $1.49 per share, according to FinChat data.

The New York Stock Exchange parent company reported fourth-quarter net revenue of $2.32 billion, which was in line with Street estimates.

The company’s exchange net revenue rose 9% to $1.2 billion compared to last year. Its energy exchange revenue jumped 16% to $477 million, while financial revenue grew 30%.

ICE's energy trading volumes jumped 15%, with power, oil, and refined products growth. Natural gas average daily volumes rose 17%.

Its listing revenue rose 1% to $123 million for the fourth quarter.

Its fourth-quarter fixed income and data services revenues rose 3% to $579 million, while mortgage technology revenue grew 1% to $508 million.

ICE raised its quarterly dividend by 7%.

The company expects to resume share repurchases in the first quarter.

ICE forecast 2025 adjusted expenses in the range of $3.92 billion to $3.97 billion.

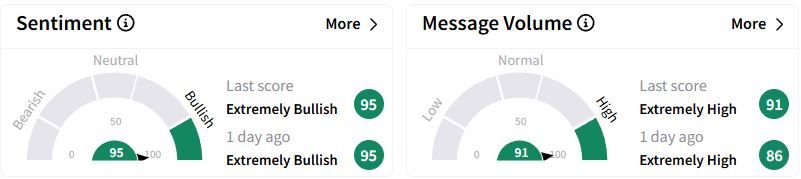

Retail sentiment on Stocktwits remained in ‘extremely bullish’ (95/100) territory, while retail chatter was ‘extremely high.’

In January, rival Nasdaq had also topped quarterly profit estimates.

Over the past year, ICE stock has gained 32.4%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<