Li told employees at a Monday internal meeting that Nio is aiming for full-year non-GAAP profitability, cautioning that the goal “should not be taken for granted.”

- Strong demand for the ES8, Onvo L90, and Firefly boosted Nio’s second-half recovery.

- ES8 deliveries reached 60,000 in just over four months, and Firefly defied the typical post-launch sales slowdown.

- CEO William Li credited the CBU operating model, in-house technology investments and battery swap expansion for supporting margins.

Shares of Nio, Inc. jumped about 4% in Hong Kong after CEO William Li outlined how the Chinese EV maker plans to sustain sales momentum, tighten costs, and move toward annual profitability, following its first projected profitable quarter.

NIO stock rose about 1% during U.S. trading and added another 0.4% after-hours.

Nio Pushes For Full-Year Profit

Li told employees in a Monday internal meeting that Nio is targeting annual non-GAAP profitability, warning that the milestone “should not be taken for granted.” His comments came days after the company flagged its first-ever quarterly operating profit for the fourth quarter (Q4) of 2025, driven by higher deliveries, a stronger product mix and ongoing cost controls, according to a report by CnEVPost.

Nio expects adjusted operating profit of 700 million to 1.2 billion yuan for Q4, versus a loss a year earlier, marking a turning point after several years of heavy investment.

Models Lifting Nio’s Profitability

Li said Nio’s rebound in the second half of 2025 was anchored by strong demand for three models: the updated ES8, the Onvo L90 and the Firefly. The third-generation ES8 delivered 60,000 units in just over four months and was a key contributor to Q4 profitability, while the Onvo L90 posted consistent monthly deliveries above 10,000 units.

He highlighted Firefly as an example of how Nio is addressing what he described as the industry’s “new car death valley effect,” where sales fade after an initial launch surge. Li said Firefly continued to gain traction even after its launch, reinforcing confidence in the company’s product positioning and execution.

Operational Overhaul Supports Margins

Li attributed last year’s progress in part to the Cell Business Unit (CBU) operating model, which he said sharpened accountability and improved efficiency across teams. He said the focus now is on scaling those gains into repeatable, year-on-year operational improvements.

The CEO also cited Nio's continued investment in its in-house technology, including its vehicle operating system, smart driving chips, and intelligent chassis, which were deployed in vehicles entering mass production last year. Li said increasing research and development (R&D) efficiency and applying greater return-on-investment discipline would be key to sustaining margins.

Battery Swap Remains Core Strategy

Li expressed confidence again in Nio’s battery swap service following the company’s milestone of 100 millionth swap earlier this month. The company currently has over 3,700 swap stations and expects to install another 1,000 this year. It will remain a core pillar for keeping users engaged with the company and driving long-term profits, he added.

However, Nio has cautioned that early 2026 could be challenging as industry-wide stimulus measures, including purchase tax incentives, begin to fade.

How Did Stocktwits Users React?

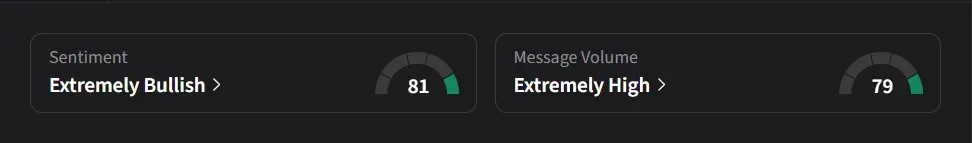

On Stocktwits, retail sentiment for Nio was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “I see $6.00. I say maybe end of this week!”

Another user called the stock a “long-term hold,” saying they see “10X [gains], when we show increasing revenue and profits for many years to come. Believe and be patient.”

U.S.-listed shares of Nio have risen 15% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<