All sectors except auto, select FMCG, and private bank stocks were in the red.

Indian stock markets opened on a subdued note on Tuesday as investors digested mixed global cues, remarks regarding U.S. tariffs, and ongoing India-Pakistan border tensions.

Around 9:45 a.m. IST, the benchmark Nifty edged lower to around 24,440, and the Sensex traded slightly lower at around 80,700. Broader markets underperformed.

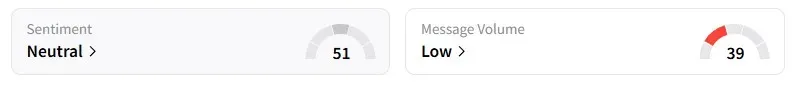

Data on Stocktwits shows that retail sentiment for the Nifty 50 has turned 'neutral' from 'bullish' a day ago.

All sectors except auto, select FMCG, and private bank stocks were in the red.

Pharma stocks led the decline, with Sun Pharma, Dr. Reddy's Labs, and Cipla falling about 2% following an U.S. executive order aimed at easing pharmaceutical plant approvals, signed by President Trump on Monday.

YES Bank shares saw 6% gains. News reports indicate the Reserve Bank of India has approved Sumitomo Mitsui Banking Corp's acquisition of a 51% majority stake in the private lender.

Indian Hotels saw a 3% fall despite the Tata Group company reporting a 25% net profit increase to ₹522.3 crore and a 27.3% revenue rise to ₹2,425.1 crore in its fourth quarter.

Coforge gained 3% after delivering strong quarterly numbers and offering upbeat FY26 guidance despite global macro uncertainty.

Paras Defence rose 2% on plans to form a joint venture with Israel's HevenDrones to produce defense and civil drones.

Investors will monitor Bank of Baroda, Paytm, Godrej Cons, HPCL, and MGL as they report quarterly numbers later in the day.

SEBI-registered research advisor shared the day's trade set-up on Stocktwits.

Prabhat Mittal identified Nifty support at 24,280 and resistance at 24,620. For Bank Nifty, he pointed to support at 54,500 and resistance at 55,300.

Asian markets were mostly higher, although Japan and South Korea remained shut for the day. Meanwhile, Dow Futures were slightly lower as investors weighed potential Federal Reserve moves and tariff-related risks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<