The company posted its 12th consecutive quarter of growth, supported by new hotel additions and international expansion. Despite this, shares fell over 4% amid cautious technical sentiment and weak short-term signals.

Indian Hotels Company Ltd (IHCL) has reported strong results for fourth-quarter (Q4) FY25, but technical resistance near key levels suggests caution for investors, according to SEBI-registered analyst Mayank Singh Chandel.

The company’s Q4 profit surged 28.4% year-on-year to ₹562.66 crore, with revenue rising 27.3% to ₹2,425 crore.

Operating profit (EBITDA) increased by 29.9%, and the EBITDA margin improved to 35.3% from 34.6% in the previous year.

The management highlighted this as the 12th consecutive quarter of strong growth, driven by hotel additions and expanding international presence.

However, Chandel noted that the IHCL stock has been consolidating in recent months and is facing significant resistance between ₹840 and ₹855, with price action failing to sustain above this range.

The stock is currently trading below its 50-day exponential moving average (EMA) of ₹793, which signals short-term weakness.

Additionally, the Relative Strength Index (RSI) is at 43, indicating mild bearish momentum but not yet oversold conditions.

Chandel advised that investors should consider buying only if the stock closes above ₹855 with strong volume, which would confirm a breakout and suggest potential for further gains.

On the downside, immediate support is seen between ₹740 and ₹750. If the stock breaks below ₹740, further declines toward ₹700 or the 200-day EMA are possible.

While IHCL's fundamentals remain strong, with solid growth in revenue and profitability, Chandel stressed that the technical outlook calls for caution in the short term.

Investors should wait for a clear breakout or a strong reversal from support levels before making fresh investments. Chandel said.

At the time of writing, shares of Indian Hotels were trading at ₹765.45, down 4.53% on the day.

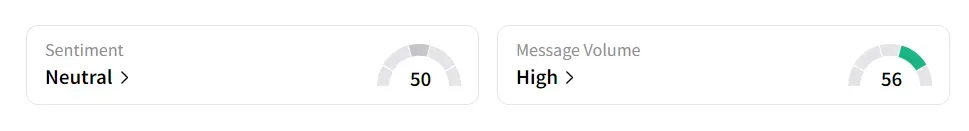

On Stocktwits, sentiment was ‘neutral’ amid ‘high’ message volume.

Shares of IHCL have fallen 12.4% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<