Market sentiment remains positive across most sectors except PSU banks and consumer durables. Tech stocks are fueling early market gains.

Indian markets continued their strong run this week, rising early on Wednesday and eyeing a seventh session of gains. Benchmark indices rose nearly 1%, with broader markets mirroring similar gains.

At 9:40 am IST, the benchmark Nifty was up 0.4% at 24,277, while the Sensex rose 0.7% to 80,211.

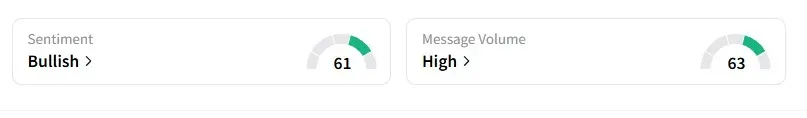

Data from Stocktwits showed that sentiment around the Nifty 50 turned 'bullish' from 'neutral' a day ago, indicating rising retail investor confidence.

All sectors were in the green except public sector banks and consumer durables.

IT stocks were among the early stars, with HCL Tech leading the rally. The company's stock gained nearly 6% following its fourth-quarter earnings release, and investors cheered its full-year guidance that was relatively better than peers.

Cyient DLM surged nearly 8% after its fourth-quarter net profit surged 37% due to robust revenue growth and improved margins.

Waaree Energies continued its rally, as the stock surged 6% in opening trade. The solar company posted a 34% rise in profits at ₹619 crore, while revenue rose 36% year-on-year (YoY). This stock has now clocked a 24% gain in the last five days.

IndusInd Bank's stock rose 2% on Wednesday after it clarified to the stock exchanges that it had not hired EY for a forensic audit. The bank stated that EY was engaged only to assist its Internal Audit Department in reviewing records of its Microfinance business and not to conduct a forensic investigation.

Construction engineering firm Ashoka Buildcon gained 4%, driven by a ₹568.86-crore contract from Central Railways for a gauge conversion project in Maharashtra.

On earnings radar, investors will monitor LTIMindtree, Tata Consumer, 360 One Wam, Bajaj Housing Finance, Can Fin Homes, and Dalmia Bharat as they report quarterly numbers later on Wednesday.

SEBI-registered research analyst Bharat Sharma said on Stocktwits that Nifty's broader trend and sentiment remain bullish unless there are clear signs of a reversal.

Sharma pegs immediate resistance at 24,180, slightly adjusted downward due to resistance from the 20-day EMA, adding that the stock could touch 24,250, 24,300, and 24,350 if it breaches that level.

Another SEBI analyst, Ashish Kyal, shared his Nifty outlook on Stocktwits India. He asserted that the index could move to 24,300 as long as 24,070 holds and that an hourly close below this level can result in a short-term consolidation between 23,980 - 24,300

Kyal's Nifty targets are 24,300, followed by 24,420.

Globally, Asian markets were mostly higher, while U.S. equity futures rose after Trump softened his stance on the Federal Reserve head and China tariffs.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<