Indian equities bounced back after a four-day slide, with Nifty testing the 25,200 mark and Sensex rising 317 points.

Indian equity markets snapped a four-day losing streak, with the Nifty index testing the 25,200 level at the close. The resurgence was led by strong buying in auto and pharmaceutical stocks.

Meanwhile, trade discussions between India and the United States are progressing rapidly, according to Commerce and Industry Minister Piyush Goyal. This comes as Indian negotiators began another round of talks in Washington on Monday.

On Tuesday, the Sensex closed 317 points higher at 82,570, while the Nifty 50 ended 113 points higher at 25,195. Broader markets outperformed, with the Midcap index rising 0.7% and the Smallcap indices gaining nearly 1%.

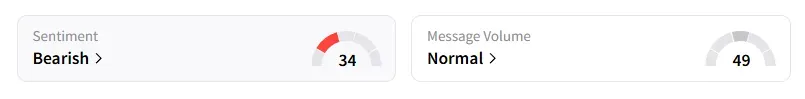

However, the retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ on Stocktwits.

Sectorally, all indices ended in the green, led by auto (+1.5%), pharma (+1.1%), FMCG, real estate, and consumer durables (+0.8%).

Hero Motocorp emerged as the top gainer on the Nifty, with its shares climbing 5%, following the release of its annual report, which outlined an ambitious growth strategy for FY26. Key initiatives include expanding international operations, enhancing its premium motorcycle offerings, and maintaining strong retail sales in the domestic market.

HCL Technologies was the top Nifty loser, ending 3% lower after its first-quarter (Q1 FY26) earnings and guidance disappointed the street.

Shares of Tejas Networks tumbled to a two-year low, ending 6% lower after the company swung to losses and reported a steep drop in revenues in Q1.

Analyst Sunil Kotak noted that the Nifty index was taking support around the 50-day Simple Moving Average (SMA). He expects the markets to remain sideways till Nifty is below 25,200. The bias will turn bullish once the index closes above the level.

Globally, European markets traded mixed, while US stock futures indicate a positive start on Wall Street. Oil prices dipped after US President Donald Trump gave Russia 50 days to end the Ukraine war or face 100% tariffs on its oil exports.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <