The company has adjusted its full-year revenue guidance to $4.1 billion to $4.21 billion, reflecting the benefits of foreign exchange impacts, up from its previous estimate of $4.06 billion to $4.17 billion.

Shares of IDEXX Laboratories, Inc. (IDXX) traded 9% higher on Thursday afternoon after the company reported upbeat first-quarter profit and raised its annual forecast.

The veterinary diagnostics company’s first-quarter (Q1) revenue came in at $998 million, marking an increase of 4% year-on-year (YoY), but below an analyst estimate of $999.52 million, as per Finchat data.

Diluted earnings per share came in at $2.96, up from $2.81 in the corresponding period of 2024, and exceeding an estimated $2.84.

The company adjusted its full-year revenue guidance to $4.1 billion to $4.21 billion, reflecting the benefits of foreign exchange impacts, up from its previous estimate of $4.06 billion to $4.17 billion.

IDEXX also updated its full-year EPS outlook to $11.93 to $12.43, up from previous guidance of $11.74 to $12.24. The new earnings guidance includes a favorable adjustment to a now-concluded litigation matter expense accrual, the company said.

The firm also updated its full-year operating margin outlook to 31.1% to 31.6% from 31% to 31.5%, including estimates for the impact of tariffs.

The new estimates include tariffs on internationally sourced materials, based on current U.S. pronouncements and forecasts for China’s retaliatory tariffs, the company said.

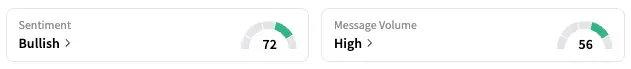

On Stocktwits, retail sentiment around IDEXX fell from ‘extremely bullish’ to ‘bullish’ territory over the past 24 hours while message volume jumped from ‘extremely low’ to ‘high’ levels.

IDXX stock is up by over 15% so far this year and by nearly 1% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<