HYPE’s token price is up more than 14% year to date, while COIN’s stock is down over 27%.

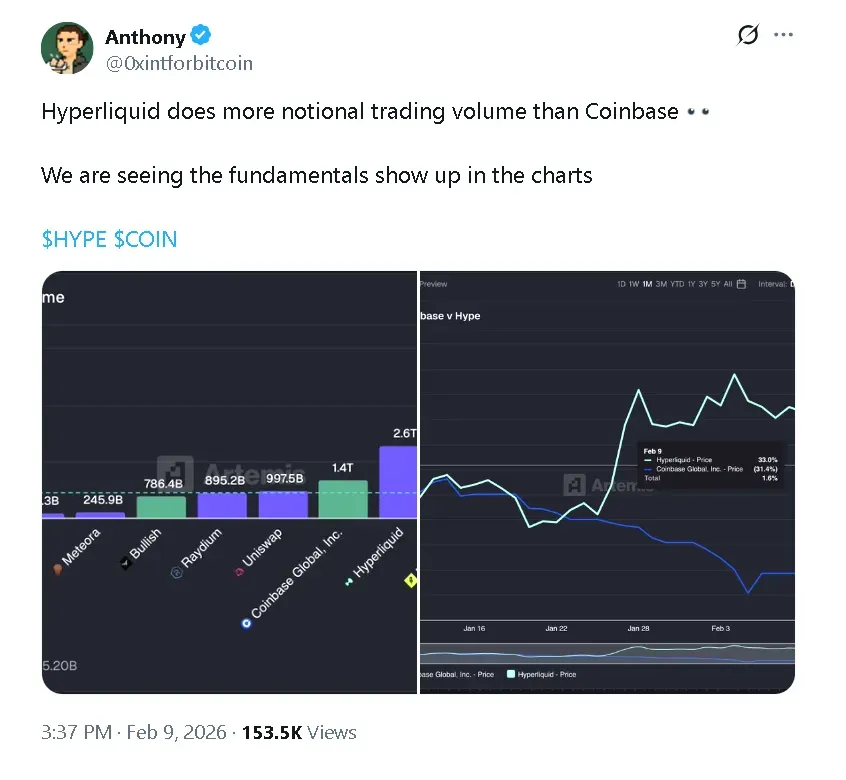

- Data from Artemis showed that Hyperliquid processed roughly $2.6 trillion in notional trading volume on Monday.

- This was nearly double the $1.4 trillion trading volume Coinbase saw during the same session.

- Retail sentiment around COIN’s stock on Stocktwits was trending in ‘extremely bullish’ territory, with some users anticipating the company’s upcoming fourth-quarter earnings to provide a rally.

The largest decentralized crypto exchange (DEX) globally overtook Coinbase (COIN) on Monday with daily trading volumes surpassing the Brian Armstrong-led enterprise despite operating entirely on-chain.

Data from Artemis showed that Hyperliquid (HYPE) processed roughly $2.6 trillion in notional trading volume, nearly double Coinbase’s $1.4 trillion on Monday.

HYPE’s price, the native token behind the DEX, has gained more than 14% this year as of Tuesday morning, meanwhile COIN’s stock has dipped over 27% amid the bearish market sentiment around equities and cryptocurrencies earlier this year – marking a divergence of 41% within a matter of weeks.

Traders Are Betting On Coinbase Earnings To Lift Stock

HYPE’s price was down 6.2% in the last 24 hours as of Tuesday morning amid broader weakness in the crypto market. Retail sentiment around the altcoin on Stocktwits fell to ‘bullish’ from ‘extremely bullish’ territory, but chatter remained at ‘extremely high’ levels.

Meanwhile, COIN’s stock fell as much as 1.72% in pre-market trade, with retail sentiment in ‘extremely bullish’ territory and chatter at ‘extremely high’ levels over the past day. The crypto exchange is scheduled to report its earnings on Thursday, with Wall Street expecting adjusted earnings per share of $0.99 on revenue of $1.84 million, according to Koyfin data.

One bullish user on Stocktwits forecast that COIN’s stock will make a comeback ahead of earnings after a drop of over 10% this month, as Bitcoin’s price came close to sliding below $60,000.

Another anticipates “choppy waters” with the CLARITY Bill markup getting delayed over stablecoin yields and the accompanying fallout between CEO Brian Armstrong and Washington.

Centralized Crypto Exchanges Versus Decentralized Crypto Exchanges

Coinbase operates as a centralized exchange with regulated custody, fiat on-ramps, and a strong institutional client base. Hyperliquid, on the other hand, functions as a blockchain-native platform focused primarily on perpetual futures and derivatives. It settles trades on-chain, with an emphasis on transparency within the decentralized finance (DeFi) infrastructure.

The success of Hyperliquid has been attributed to several factors, including competitive fee structures, quicker and more efficient execution models, and the ability for traders to maintain self-custody while trading.

During volatile market periods, derivatives-focused platforms like Hyperliquid often see spikes in activity.

Read also: Cathie Wood’s ARK Adds Bullish Shares After Peter Thiel–Backed Crypto Exchange Jumps 16%

For updates and corrections, email newsroom[at]stocktwits[dot]com.<