HPCL reported an 18% jump in Q4 profit to ₹3,355 crore, supported by strong refining margins and lower crude prices. Analysts remain positive but advise caution, with resistance seen in the ₹410–₹422 range and signs of profit booking.

Hindustan Petroleum Corporation (HPCL) reported a strong set of numbers for the fourth quarter (Q4), posting an 18% year-on-year rise in profit after tax to ₹3,355 crore.

The state-run oil marketing company also declared a final dividend of ₹10.50 per share.

SEBI-registered analyst Mayank Singh Chandel notes that HPCL’s results were supported by improved refining margins, lower crude oil prices, and steady growth in refinery throughput and fuel sales.

Management remains confident, highlighting strong cash reserves and stable operational performance.

From a technical perspective, Chandel points out that HPCL’s stock is currently facing resistance in the ₹400–₹422 range, where it has struggled to break higher. Near-term support is observed between ₹375 and ₹370, with a major long-term base around ₹300–₹290.

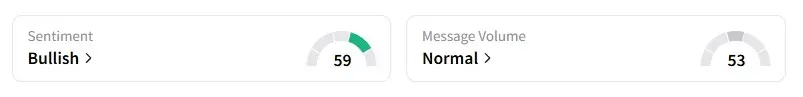

The stock is trading above its 50-day EMA, and the RSI near 59.76 signals a bullish bias, though not yet overbought.

He suggests that aggressive traders could consider entries near current levels with tight stop-losses, while conservative traders may prefer to wait for a confirmed close above ₹422 to validate a breakout and trend continuation.

However, if the price falls below ₹370, a further correction toward ₹350 or even ₹300 is possible.

Overall, Chandel believes HPCL is fundamentally and technically strong, but emphasizes that a breakout above ₹422 is necessary to confirm further momentum, advising traders to position themselves according to their risk appetite.

On the other hand, Prameela Balakkala advises caution before initiating any short-term long positions in HPCL unless there is a clear and confirmed bullish reversal setup.

While momentum appears firm, she flags signs of mild distribution and profit booking in the ₹410–₹412 band.

She also points out a 2% YoY revenue decline, which may lead to short-term consolidation. Without a confirmed breakout or reversal, Prameela suggests avoiding fresh long positions for now.

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter.

HPCL shares have fallen 3% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<