The company is poised for international expansion in FY26 and a potential breakout on the charts, with analysts forecasting a 13% upside in the near term.

India’s biggest two-wheeler manufacturer, Hero MotoCorp, shows no signs of stopping. The automaker indicated that FY26 will be a crucial year for its international expansion, following strong growth in FY25.

Hero recently announced plans to enter key European markets, including Germany, France, Spain, and the UK, in the second quarter of fiscal 2026. The move follows a 43% increase in international business, driven by strong demand in South Asia and Latin America.

Domestically, it is witnessing a strong recovery in rural demand, especially in the entry-level motorcycle segment, where it gained 600 basis points in market share.

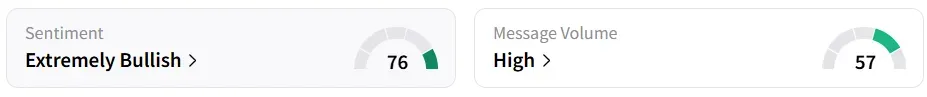

Retail sentiment on Stocktwits turned ‘extremely bullish,’ amid ‘high' message volumes. It was ‘bullish’ a day earlier. It is among the top trending stocks on the platform.

At the time of writing, the shares were down 1.5% on Wednesday, having gained around 6% year-to-date.

Robust technical signals back the fundamentals

The stock continues to consolidate in a rectangle pattern between ₹4,200 and ₹4,500 on the daily chart, noted SEBI-registered analyst Pradep Carpenter. In Tuesday’s session, the stock rallied toward the upper end of this range, nearing a critical breakout point.

A decisive move above ₹4,500 could open the door for a fresh rally, with potential short-term targets at ₹4,900 and ₹5,100, he added.

Hero MotoCorp stock has closed above its 200-day simple moving average (SMA) on Tuesday, while momentum indicators like the moving average convergence/divergence (MACD) are on the verge of a bullish crossover above the zero line, and the relative strength index (RSI) is rising toward the overbought zone, suggesting increasing price strength.

The foray into electric mobility has materialized well with Hero’s EV brand, Vida, selling over 58,000 units in FY25. It is set to launch two new models while expanding to more than 200 cities.With a favorable monsoon, improving rural sentiment, and easing interest rates, the company is well-positioned for further upside, especially if it breaks out above ₹4,500, according to Carpenter.

Meanwhile, analyst Vinay Kumar Taparia noted that the stock has broken out of a narrow 250-point range on strong volume, indicating bullish momentum. He recommends a ‘buy’ at the current market price and on dips near ₹4,300, with upside targets of ₹4,850 and ₹5,250.

A close below ₹4,160 would invalidate the setup and should be used as a stop-loss, Taparia added.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <