Eric Trump also told CNBC that the “best is yet to come” for the cryptocurrency sector.

- Eric Trump reiterated his $1 million price target for Bitcoin, despite recent price weakness.

- Donald Trump Jr. stated that USD1 was the “fastest growing” stablecoin in history and is bringing in trillions of dollars into the economy.

- Their comments came alongside the announcement of two new partnerships, both focused on the tokenization of real-world assets.

World Liberty Financial (WLFI) co-founder Eric Trump reportedly said on Thursday that crypto is "on the one-yard line", predicting explosive growth for WLFI's USD1 stablecoin (USD1).

“We're on the one-yard line,” Eric Trump told CNBC at the World Liberty Forum in Florida. “The best is yet to come for this industry.” He stuck to his prediction that Bitcoin’s (BTC) price is set to hit $1 million and added that “he’s never been more bullish on Bitcoin” in his life.

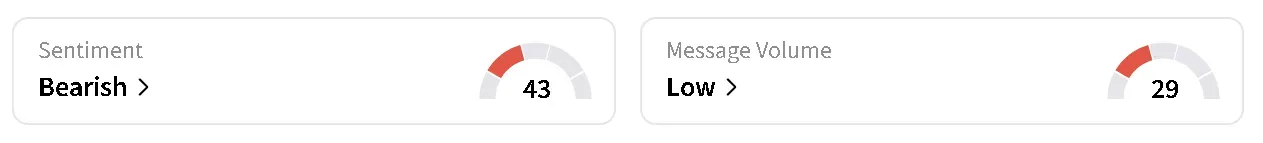

Meanwhile, Bitcoin has been struggling to climb back up to $100,000 this year. BTC’s price was trading at around $67,000 on Thursday night, down 1.6% in the last 24 hours. On Stocktwits, retail sentiment around the apex cryptocurrency trended in ‘bearish’ territory over the past day.

USD1 Is Bringing In Trillions Of Dollars

According to Donald Trump Jr., USD1 is the “fastest growing” stablecoin in U.S. history. “It’s bringing in trillions of dollars into the U.S. right now. Everyone wants to be on the U.S. dollar.” Eric Trump added.

Their comments follow World Liberty Financial’s announcement on Thursday that it is partnering with the Apex Group, a financial services provider managing over $3.5 trillion in assets, to boost USD1’s use cases. The companies said they will pilot USD1 for subscriptions, distributions, and redemptions of tokenized assets. Their goal is to integrate USD1 into traditional fund administration for institutional clients.

The company also announced plans to tokenize loan revenue interests in Trump International Hotel & Resort in the Maldives in partnership with Securitize and DarGlobal PLC – another push into real-world assets (RWAs).

What Is Retail Saying?

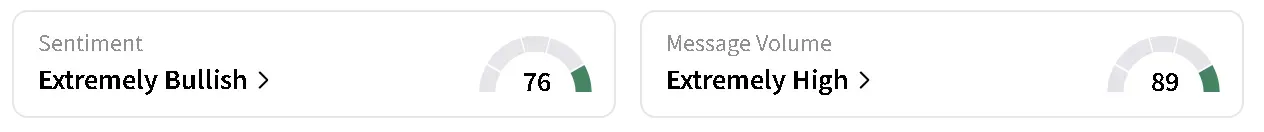

WLFI’s price was trading at around $0.116, paring gains after clocking an intra-day high of around $0.128. The crypto token is down nearly 65% from its record high of $0.331, seen in September last year. On Stocktwits, retail sentiment around WLFI’s token dipped to ‘bullish’ from ‘extremely high’ territory over the past day, but chatter rose to ‘extremely high’ from ‘high’ levels.

One user said they anticipate WLFI’s price will reach $0.20 by March.

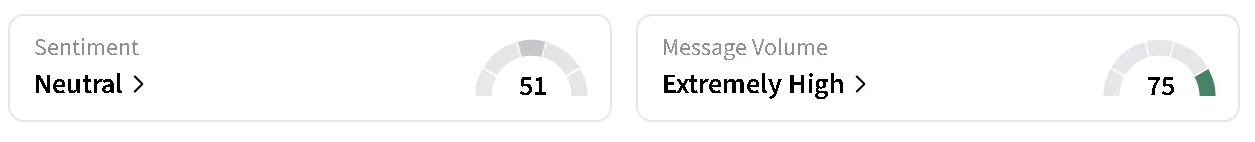

Meanwhile, retail sentiment around USD1 fell to ‘neutral’ from ‘bullish’ territory over the past day, but chatter remained at ‘extremely high’ levels.

Analysts at Blockstreet reportedly predicted USD1 could challenge Tether (USDT) and Circle Internet’s USDC (USDC) by 2028. They cited support from the Trump administration and institutional interest as the primary drivers of the flip, cautioning that USD1 also faces rising competition amid a stablecoin market projected to hit $2 trillion.

Read also: Coinbase CEO Predicts ‘Win-Win-Win’ Result – CLARITY Act Approval Odds Climb to 90% On Prediction Markets

For updates and corrections, email newsroom[at]stocktwits[dot]com.<