The company also announced that its Board of Directors authorized an additional $500 million for share purchases under its existing share repurchase program.

Shares of EMCOR Group, Inc. (EME) soared over 7% on Wednesday, heading toward their best single-day session in a year. The rally followed the company’s upbeat fourth-quarter earnings and strong outlook for 2025.

EMCOR provides mechanical and electrical construction services as well as industrial, energy infrastructure, and building services.

During the fourth quarter (Q4), revenue rose almost 10% year-over-year (YoY) to a record of $3.77 billion versus a Wall Street estimate of $3.81 billion. Earnings per share (EPS) came in at $6.32 versus an analyst estimate of $5.76.

Net income rose 38% YoY to $292.2 million during the quarter.

For 2025, the company expects revenues between $16.1 billion and $16.9 billion compared to a Street estimate of $15.79 billion. Diluted EPS is expected to be in the range of $22.25 to $24.00, compared to an analyst estimate of $22.89.

CEO Tony Guzzi said the company anticipates continued momentum in demand, as evidenced by the 14.2% YoY increase in its remaining performance obligations.

“Our total and organic revenue growth of 15.8% and 13.8%, respectively, and operating income growth of 53.6%, were fueled by our execution in key market sectors such as network and communications, high-tech manufacturing, institutional, healthcare, and manufacturing and industrial,” he noted.

EMCOR also announced that its Board of Directors authorized an additional $500 million for share purchases under its existing share repurchase program.

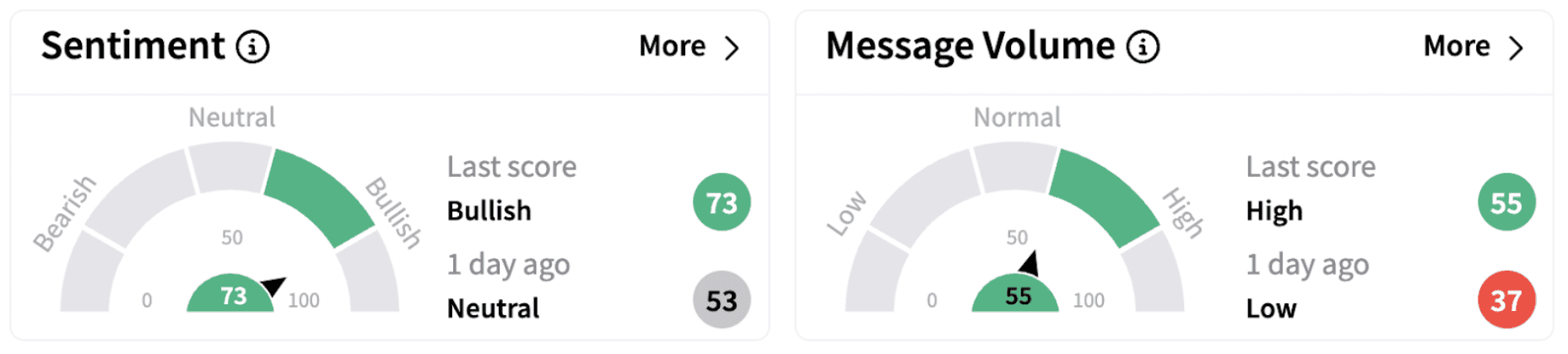

On Stocktwits, retail sentiment on Stocktwits climbed into the ‘bullish’ territory (73/100) from ‘neutral’ a day ago. The move was accompanied by ‘high’ retail chatter.

EME stock has lost over 6% in 2025 but has gained over 56% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<