The acquisition will add two new treatments to BioMarin’s existing medicines for rare inherited metabolic disorders.

- The deal values Amicus at $14.50 per share, representing a 33% premium to its $10.90 closing price on Thursday.

- Amicus settled its patent dispute with Indian drugmakers Aurobindo Pharma and Lupin over proposed generic versions of Galafold.

- BioMarin plans to fund the acquisition with a mix of existing cash and about $3.7 billion in new debt

Amicus Therapeutics (FOLD) shares jumped more than 30% in on Friday, to their highest level since January 2024, after BioMarin Pharmaceutical (BMRN) agreed to acquire the company in a $4.8 billion all-cash deal.

The deal values Amicus at $14.50 per share, representing a 33% premium to its $10.90 closing price on Thursday. The transaction is expected to close in the second quarter of fiscal 2026. Biomarin shares gained 6.6%.

Both FOLD and BMRN were among the top trending tickers on Stocktwits.

Portfolio Expansion And Revenue Pipeline

The acquisition will expand BioMarin’s portfolio, adding two new treatments to its existing medicines for rare inherited metabolic disorders.

Galafold for Fabry disease and Pombiliti + Opfolda for Pompe disease generated $599 million in combined net revenues over the past four quarters. U.S. exclusivity for Galafold is projected through January 2037 following recent patent settlements.

The deal is expected to boost revenue as soon as it closes and add to earnings within the first year. BioMarin expects the acquisition to become meaningfully more accretive from 2027.

The company plans to fund the acquisition with a mix of existing cash and about $3.7 billion in new debt, with Morgan Stanley providing a bridge financing commitment.

IP Dispute Update

Separately, Amicus settled its patent dispute with Indian drugmakers Aurobindo Pharma and Lupin over proposed generic versions of Galafold. Under the agreements, the companies will be allowed to launch generics in the U.S. starting January 30, 2037, subject to FDA approval.

As part of the settlement, all ongoing Hatch-Waxman litigation between the parties will be terminated, and U.S. antitrust authorities will review the agreements.

How Did Stocktwits Users React?

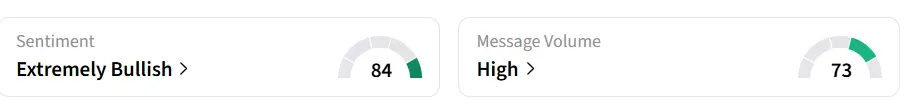

Retail sentiment for Biomarin on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a day earlier, amid ‘high' message volumes.

One user highlighted the visibility of BMRN’s FY2027 revenue target.

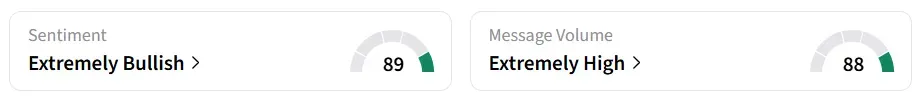

Retail sentiment for Amicus on the platform remained in the ‘extremely bullish’ zone over the past 24 hours, amid ‘extremely high message volumes.

Year-to-date, FOLD stock has gained 15% while BMRN has declined over 20%.

Read also: This New Product Launch Is Lifting Amesite Shares Premarket — Here’s What Investors Are Watching

For updates and corrections, email newsroom[at]stocktwits[dot]com.<