The stock’s rise followed FDA Commissioner Marty Makary's warning against companies marketing illegal copycat drugs.

- Regulatory scrutiny around compounded GLP-1s pushed investors toward established, FDA-approved drugmakers like Lilly.

- Analysts raised targets on Lilly, citing momentum in obesity drugs and pipeline strength, implying a 23%-27% upside.

- Lilly reported Q4 revenue growth and noted that drug-pricing initiatives like TrumpRx could expand access.

Shares of Eli Lilly & Co. rose in after-hours trading on Thursday as investors gravitated toward established drugmakers with FDA-approved obesity treatments, following fresh regulatory warnings that refocused attention on the risks around compounded GLP-1 products.

However, the stock logged its worst day in six months on Thursday after tumbling nearly 8% in the regular session.

Hims GLP-1 Rollout Triggers FDA Warning

The rise in the stock followed comments from FDA Commissioner Marty Makary, who said the agency would take “swift action” against companies broadly marketing illegal copycat drugs, adding that the FDA cannot ensure the safety, quality, or effectiveness of medicines that do not receive FDA approval.

The remarks came the same day Hims & Hers Health said it plans to sell compounded semaglutide pills, a move that prompted Novo Nordisk to threaten legal and regulatory action, saying the product amounted to illegal mass compounding of an unapproved drug.

Earlier this week, the FDA also said unapproved versions of GLP-1 drugs bypass FDA review and oversight and should be used only when FDA-approved products are unavailable or cannot meet a patient’s needs, citing concerns around storage, dosing errors, and fraud.

Wall Street View On LLY

Meanwhile, Wall Street analysts have raised price targets on Lilly, reinforcing its appeal as a relatively safe haven.

Scotiabank lifted its target to $1,300 from $1,165, implying a 27% upside, citing upward earnings revisions tied to strength in Lilly’s obesity franchise. Truist raised its target to $1,281 from $1,182, implying a 26% upside, and pointed to global expansion of Mounjaro and the expected U.S. launch of oral obesity pill Orforglipron.

Bank of America Securities increased its target to $1,293 from $1,265, pointing to a 27% upside, highlighting stronger revenue forecasts driven by Zepbound and Mounjaro. Goldman Sachs also lifted its target to $1,260 from $1,145, marking a 23% upside, citing confidence in sustained obesity-market growth.

Wells Fargo moved its target to $1,280 from $1,200, while BMO Capital and JPMorgan both raised targets to $1,300, pointing to a commercial portfolio that “continues to shine” and leadership in incretin drugs.

Strong Earnings Support Lilly Stock

Recent results have underpinned the optimism in the stock. Lilly reported fourth-quarter revenue of $19.3 billion, up 43% year over year, and forecast 2026 revenue of $80 billion to $83 billion, above consensus expectations. Sales of Tirzepatide, sold as Mounjaro for diabetes and Zepbound for obesity, nearly doubled last year to $36.5 billion, making it the world’s top-selling drug.

The company has continued to gain share in the U.S. GLP-1 market, supported by demand for Tirzepatide-based treatments. Attention is also turning to Lilly’s oral obesity candidate, Orforglipron, which the company expects to seek U.S. approval in the second quarter. The company added that broader Medicare coverage for obesity treatments, expected to begin later this year, could be a “compelling value proposition” for users.

TrumpRx Puts Drug Pricing In Focus

Drug pricing also stayed in focus for Lilly after U.S. President Donald Trump launched TrumpRx.gov, a new website designed to let consumers buy select prescription medicines directly at discounted prices by linking them to manufacturers’ platforms and bypassing pharmacy benefit managers. Trump said more than 40 commonly used drugs would be available, including Ozempic and Wegovy, both marketed by Novo Nordisk, offered at $199.

The initiative follows pricing agreements with several large pharmaceutical companies, including Lilly, and aims to improve access for patients facing high copays or coverage gaps.

How Did Stocktwits Users React?

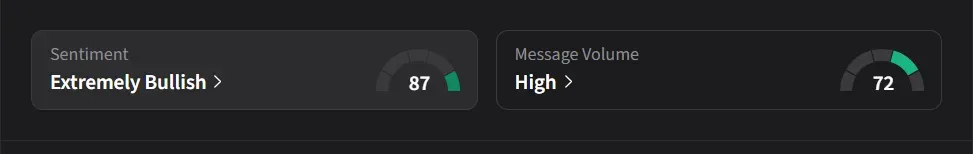

On Stocktwits, retail sentiment for Lilly was ‘extremely bullish’ amid ‘high’ message volume.

Another user said the latest regulatory action has heightened pressure on the compounded-drug companies like Hims, while adding that established players such as Lilly and Novo continue to be viewed as a “safe haven.”

Another user expects Lilly’s stock to gain 5% in Friday’s session.

Eli Lilly’s stock has risen 22% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<