In the fourth-quarter, Delta recorded $16.0 billion in operating revenue and earnings per share (EPS) of $1.86, both exceeding analysts’ consensus estimates.

- The airline operator stated that its fourth-quarter (Q4) revenue growth was affected by the government shutdown.

- Delta projects 2026 earnings per share growth of 20% YoY to between $6.50 and $7.50.

- Delta sees first-quarter 2026 total revenue growth of 5-7% and earnings per share between $0.50 and $0.90.

Delta Air Lines (DAL) stock tumbled over 6% on Tuesday after a disappointing 2026 profit guidance that overshadowed a slight beat in its fourth-quarter earnings.

The airline operator also stated that its fourth-quarter (Q4) revenue growth was affected by the government shutdown as the U.S. aviation regulator ordered a 10% reduction in air traffic to reduce pressure and ensure safety.

Financial Performance And Outlook

In the fourth-quarter, Delta recorded $16.0 billion in operating revenue and earnings per share (EPS) of $1.86. Both revenue and EPS exceeded the analysts’ consensus estimate of $15.7 billion and $1.71, respectively, according to Fiscal AI data.

The company said Q4 revenue grew 1.2% year-over-year (YoY) despite a temporary government shutdown impacting domestic operations. Delta projected a 2026 earnings per share growth of 20% YoY to between $6.50 and $7.50. Delta sees first-quarter 2026 total revenue growth of 5-7% and earnings per share between $0.50 and $0.90.

"2026 is off to a strong start with top-line growth accelerating on consumer and corporate demand. For the full year, we expect to deliver margin expansion and earnings growth of 20 percent year-over-year."

-Ed Bastian, CEO, Delta Air Lines

Fleet Expansion

Additionally, Delta announced that it has reached an agreement with Boeing (BA) to acquire 30 787-10 widebody aircraft, with options for an additional 30 planes.

Deliveries are expected to start in 2031. The new aircraft promises improved fuel efficiency, cost advantages, and extended long-haul capabilities.

"Delta is building the fleet for the future, enhancing the customer experience, driving operational improvements and providing steady replacements for less efficient, older aircraft in the decade to come," added Ed Bastian.

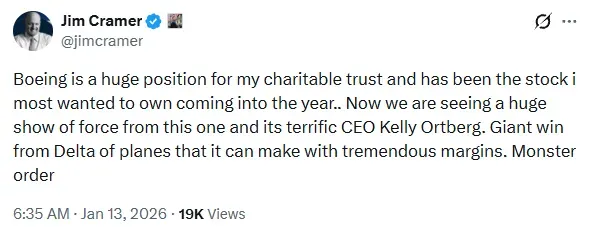

Commenting on the deal, CNBC’s Jim Cramer said in a post on X that Delta’s large aircraft order represents a major win with high profit potential.

What’s The Retail Mood On Stocktwits?

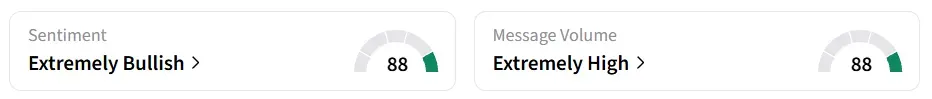

On Stocktwits, retail sentiment around Delta stock changed to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume also shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

DAL stock has gained over 9% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<