Speaking to Bloomberg TV on Friday, Ives noted that Apple’s next narrative will revolve around monetizing AI across its ecosystem of 2.5 billion iOS devices.

- Dan Ives said future investor enthusiasm will likely depend on Apple bringing in revenue opportunities from AI-powered subscriptions.

- Ives said rising memory costs could lead Apple to increase iPhone 18 prices by $100 to $150.

- The iPhone maker’s Q1 revenue of $143.8 billion and earnings per share of $2.84 both exceeded Street estimates.

Dan Ives, managing director at Wedbush Securities, reportedly said that artificial intelligence will be a central focus for Apple Inc. (AAPL) in 2026 and that the company may raise iPhone 18 prices by $100 to $150.

The tech giant’s first-quarter (Q1) financial results have sparked discussions about potential strategic shifts, including AI monetization and product pricing adjustments.

AI Strategy Takes Center Stage

Speaking to Bloomberg TV on Friday, Ives noted that Apple’s next narrative will revolve around monetizing AI across its ecosystem of 2.5 billion iOS devices. While hardware growth remains heavily dependent on the iPhone, future investor enthusiasm will likely depend on Apple bringing in revenue opportunities from AI-powered subscriptions and services.

“And I think now it's really about showing how they're going to monetize on AI.”

-Dan Ives, Managing Director, Wedbush Securities

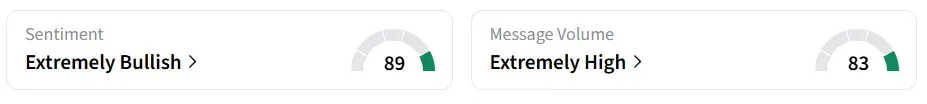

Apple stock traded over 1% lower on Friday morning. On Stocktwits, retail sentiment for the stock shifted from ‘extremely bullish’ to ‘bullish’ the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock saw a 566% increase in retail messages over the past 24 hours as of Friday morning.

Pricing Pressure On iPhones

Ives said that rising memory and component costs might lead Apple to raise the iPhone 18's price by $100 to $150. He added that these increases are unlikely to hurt margins but will be important for offsetting higher costs. The stock’s recent performance reflects investor focus on AI rather than short-term hardware profitability.

“The hearts and lungs of Apple are always going to be iPhone”, said Ives.

The iPhone maker’s Q1 revenue of $143.8 billion and earnings per share of $2.84 both exceeded the analysts’ consensus estimate of $138.22 billion and $2.67, respectively, according to Fiscal AI data. Apple’s China sales jumped about 38% year-on-year to $25.5 billion in the first quarter.

Commenting on the performance, Goldman Sachs said chip supply constraints could push back some future iPhone launches to spring 2027, according to TheFly. Apple’s profit margins hit record levels as spending increased on AI and new products, which support long-term growth, the firm added.

AAPL stock has gained over 7% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<