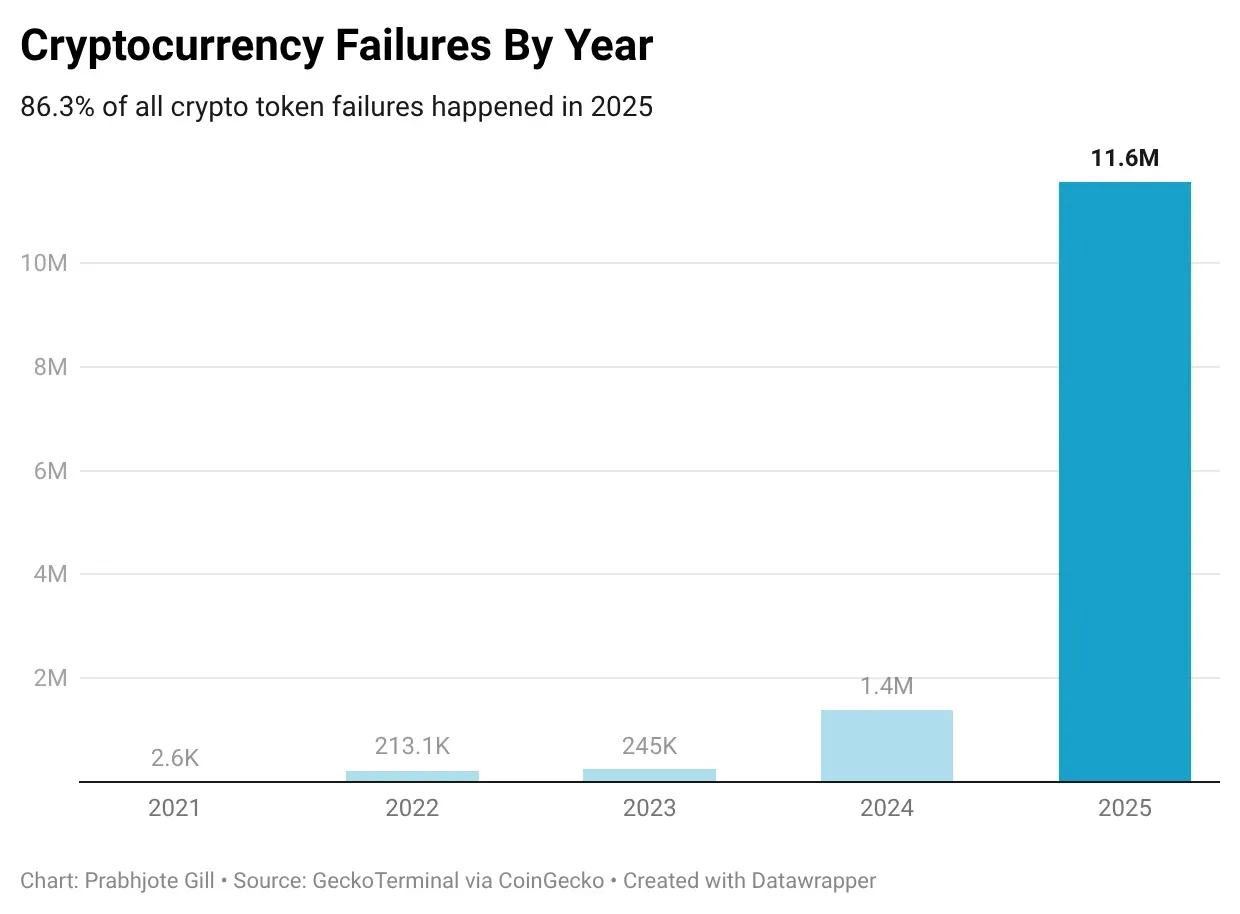

According to an analysis report by CoinGecko, more than 13.4 million tokens have failed over the past four years.

- CoinGecko recorded more than 11.6 million cryptocurrency failures in 2025 alone.

- The fourth quarter of last year accounted for over one-third of all token collapses on record.

- The report said meme coins bore a disproportionate share of the damage during the downturn.

The number of failed cryptocurrencies in 2025 was roughly eight times higher than the year before, with the final three months of the year marking the worst quarter on record.

According to an analysis report by CoinGecko, more than 13.4 million tokens have failed over the past four years, with roughly 11.6 million disappearing in 2025 alone, accounting for more than 86% of the total.

The report highlighted that not only was 2025 the most severe year on record for cryptocurrency failures, but the fourth quarter alone accounted for 7.7 million collapsed tokens. That represents 34.9% of all recorded project failures..

Market Volatility, Meme Coins Drove 2025 Washout

CoinGecko said the increase in token failures to heightened market volatility during 2025, driven by global tariff uncertainty, macroeconomic pressures, and rising geopolitical tensions. It added that meme coins bore a disproportionate share of the damage during the downturn.

The report noted that the meme coin sector’s low barriers to entry launchpads, along with speculative trading behavior, left many projects at-risk once market conditions got worse. Pump.fun (PUMP) and Raydium (RAY) saw users churning out memecoins at a record pace last year.

PUMP’s price was down 3.7% in the last 24 hours but retail sentiment around the token improved to ‘bullish’ from ‘neutral’ territory over the past day on Stocktwits. Platform data also showed chatter rose to ‘high’ from ‘normal’ levels in that same time span. RAY’s price also dipped nearly 3.7% in the last 24 hours with retail sentiment surging to ‘extremely bullish’ from ‘bullish’ territory and chatter spiking to ‘high’ from ‘normal’ over the past day.

The October 10 crash last year, where more than $19 billion in crypto bets were wiped out, made the situation a lot worse and led to the spike of dead coins in the fourth quarter. Only a few, like PEPE (PEPE) and BONK (BONK), for example, have survived the volatility and captured nearly $1 billion in market value.

PEPE’s price fell over 10% in the last 24 hours amid weakness in the broader cryptocurrency market. Retail sentiment on Stocktwits around the token dipped to ‘bearish’ from ‘neutral’ over the past day. BONK’s price was down 6.5% with retail sentiment remaining in ‘bearish’ territory.

Read also: Crypto Market Structure Bill Delayed After Coinbase Pushback – Analysts Say The Move Favors Banks

For updates and corrections, email newsroom[at]stocktwits[dot]com.<