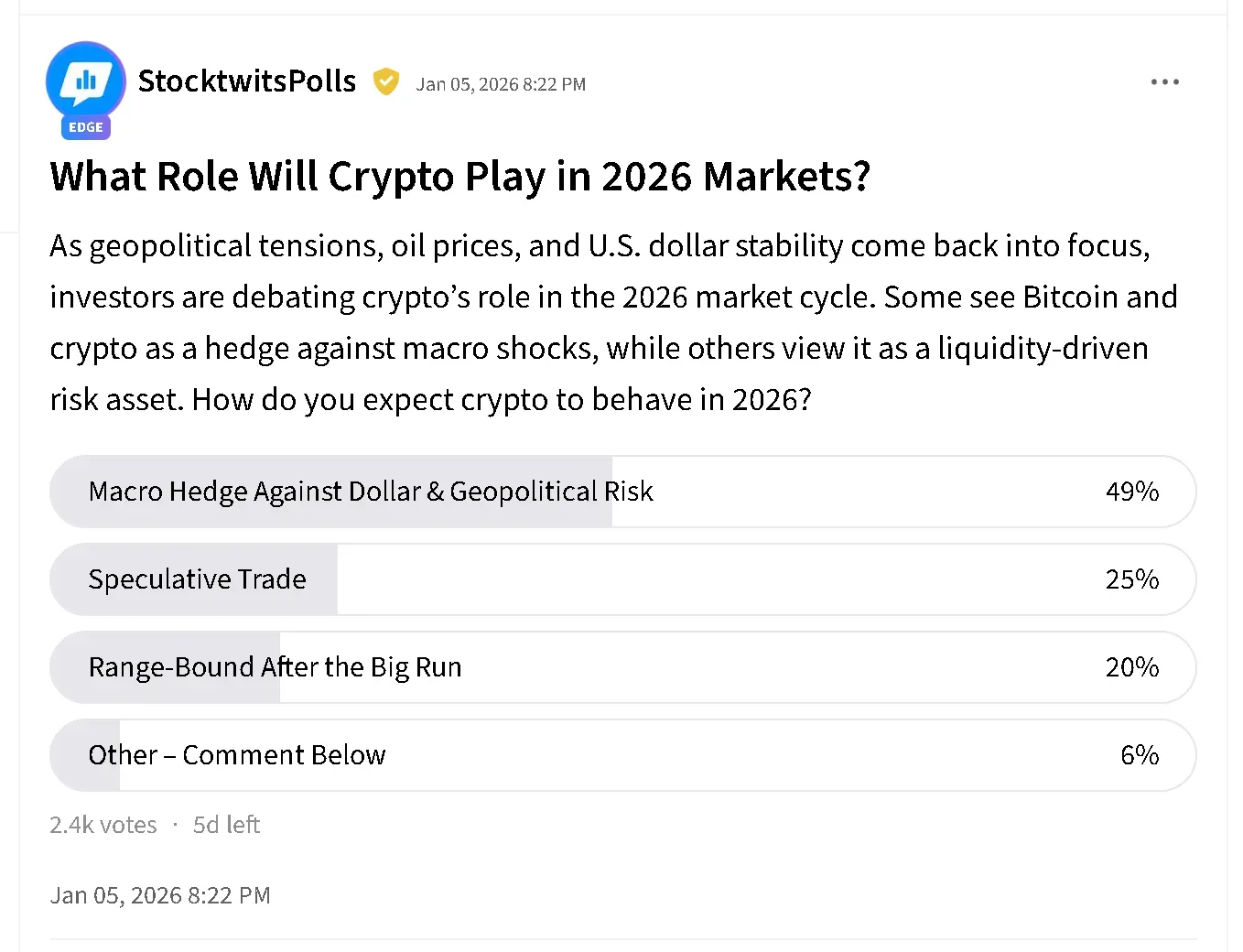

An ongoing Stocktwits poll shows half of retail traders now view crypto as protection against currency and geopolitical risks.

- Traders are also increasingly focused on long-term structural themes such as asset tokenization and platform consolidation.

- Crypto markets have remained resilient despite recent geopolitical tensions, according to Bitwise.

- Analysts say macro policy divergence and political developments remain key swing factors for 2026.

The crypto narrative for retail traders is shifting in 2026 from a primarily speculative trade to a macro hedge against currency risk and geopolitical uncertainty ahead.

According to an ongoing poll on Stocktwits, 50% of respondents now see crypto as a hedge against dollar weakness and geopolitical risk. That compares with 25% who still view digital assets as a speculative trade and 20% who expect the market to remain range-bound following last year’s record highs. Only 5% of respondents said they see crypto playing a different role in 2026.

The results mark a notable shift from prior years, when speculative positioning dominated retail sentiment across digital assets.

Other Crypto Themes Retail Sees Playing Out In 2026

One user on Stocktwits said that tokenization of assets is likely to be the biggest theme in 2026.

Another said that predictions by Fundstrat’s Tom Lee, who is also the chairman of Bitmine Immersion Technologies (BMNR), around Bitcoin (BTC) and Ethereum (ETH) will come to fruition in 2026. They added that Robinhood (HOOD) is slated to become the next generation’s wealth manager.

BMNR’s stock slipped over 1% in pre-market trade to $30.03. On Stocktwits, retail sentiment around the stock trended in ‘bullish’ territory over the past day amid ‘high’ levels of chatter. So far this year, the stock has gained more than 8%.

Meanwhile, Bitcoin clocked its first major pullback of the year this week as the price slipped from over $93,000 to below $90,000 in the last 24 hours. Retail sentiment around the apex cryptocurrency remained in ‘extremely bullish’ territory, accompanied by ‘high’ levels of chatter even as Bitcoin’s price shed 2% over the past day. Despite the recent pullback, BTC remains 2.79% in the green for the year so far.

Ethereum’s price dropped more than 3.5% in the last 24 hours to around $3,100, with chatter also at ‘high’ levels over the past day, but retail sentiment was trending in ‘bullish’ territory. It has outperformed Bitcoin this year with gains of over 4.8% so far.

Crypto Resilience Amid Geopolitical Risk

Crypto markets have shown relative resilience in recent weeks, even as geopolitical tensions increased. According to Bitwise Investments’ weekly report, major digital assets outperformed traditional markets last week, amid heightened concerns over developments involving Venezuela.

The firm said geopolitical shocks historically tend to have only short-lived effects on cryptoasset performance. It does not expect recent events to have a lasting impact on Bitcoin or the broader crypto market.

Market participants broadly agree that macroeconomic forces remain the most unpredictable drivers of crypto performance. Central bank policy divergence between major economies is emerging as a key risk, with investors watching how shifts in interest-rate paths could trigger capital flows into or out of digital assets.

Sudden macro shocks, including changes in monetary policy or escalations in geopolitical tensions, could still produce sharp moves in crypto markets next year, analysts warn.

Political developments are also shaping sentiment. With U.S. midterm elections approaching later this year, investors are closely watching signals from Washington.

Read also: Semler Outperforms Crypto Equities While Bitcoin Slips Below $91,000

For updates and corrections, email newsroom[at]stocktwits[dot]com.<