Bets on Polymarket showed a 23% chance of Netflix closing the deal by 2026-end, down from around 60% just before Trump’s comments.

- The Netflix-WBD deal could face multiple roadblocks, including a hostile bid from Paramount Skydance and an antitrust challenge from the Justice Department.

- President Donald Trump and lawmakers from both Republican and Democratic parties have expressed anti-competitive concerns.

- Paramount Skydance’s retail investors are upbeat about the stock, saying that a hostile bid is imminent.

Netflix’s eye-watering $72 billion deal for Warner Bros Discovery’s streaming and studio assets last week raised many eyebrows, with observers noting that the outcome suggests Netflix and WBD believe the deal will receive regulatory approval.

However, media reports and retail-investor chatter suggest Paramount Skydance remains emboldened and could pursue other paths to clinch the deal — and with President Donald Trump striking a cautious tone, the stage is set for sizzling drama in the months ahead.

Catching Up

Here are a few significant developments to consider since the deal was announced on Friday.

Both Republican and Democratic lawmakers have raised concerns: Republican Senator from Utah, Mike Lee, who also leads the antitrust committee, said the deal "should send alarm to antitrust enforcers around the world." Senator Elizabeth Warren said it would force “Americans into higher subscription prices and fewer choices over what and how they watch, while putting American workers at risk."

Trump said on Sunday that the deal would go through the established process. He called Netflix co-CEO Ted Sarandos “fantastic” and confirmed that he met recently with him at the Oval Office. “But it is a big market share. It could be a problem,” Trump added, noting he’ll be “involved” in the decision.

Bets on prediction marketplace Polymarket showed a 23% chance of Netflix closing the acquisition by the end of 2026, down from around 60% just before Trump’s comments, Bloomberg reported.

Netflix is expected to argue that other services, such as Alphabet’s YouTube and ByteDance’s TikTok, should be included in any market analysis, thereby dramatically shrinking the platform’s perceived market dominance, the news agency reported.

PSKY Not Taking A No

Just like Netflix, Paramount Skydance has been lobbying Washington lawmakers for the deal over the past months. Before losing the big, Paramount had warned that a Netflix deal would not clear antitrust hurdles and even questioned the fairness of the WBD bidding process.

Now, reports say Paramount could go hostile, pitching WBD shareholders on its all-cash, $30-a-share offer for the entire company — arguing it’s superior on both price and its cleaner path through regulatory approvals.

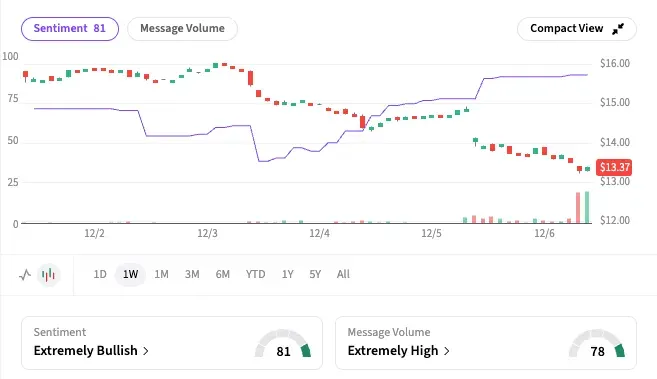

Interestingly, Stocktwits data indicates that Paramount investors believe it could still clinch the deal. Retail sentiment for PSKY has strengthened and has been firmly lodged in the “extremely bullish” zone since Friday.

“$PSKY hostile takeover is imminent now. News should be heating up this week,” said one user, summing up the mood. PSKY shedding 10% on Friday — coupled with retail investors bracing for a hostile move — has created a potent cocktail of a catalyst for the stock this week.

What Happens Now?

The U.S. has been no stranger to mega media mergers. The big ones (see table) – such as AT&T’s $85-billion acquisition of Time Warner (which included Warner Bros., Turner Broadcasting, and Home Box Office), completed in 2018, and The Walt Disney Co.’s $71 billion acquisition of Twenty-First Century Fox’s film and television assets – have made tech M&A look paltry.

| Deal< | Deal Size< | Time Taken To Close Deal< | Deal Closure Date< |

| AT&T buys Time Warner | $85B | 20 Months | Jun-18 |

| Microsoft buys Activision Blizzard | $68.7B | 21 months | Oct-23 |

| Disney buys 21st Century Fox (Assets) | $52.4B | 15 months | Mar-19 |

| Discovery and WarnerMedia merge | $43B | 11 months | Apr-22 |

| Comcast buys Europe's Sky | $39B | 5 months | Oct-18 |

Media companies have a host of assets across TV, digital, and other channels, which allows them to make tweaks to the deal or offer concessions to win regulatory approvals. AT&T and Time committed to a seven-year “no blackout” pledge, ensuring Turner networks (CNN, TBS, TNT, etc.) would stay on rival distributors’ platforms during disputes. Similarly, Microsoft and Activision said the latter’s most popular title, “Call of Duty,” would be available on gaming platforms other than Microsoft’s Xbox for 10 years.

In the case of Netflix and Warner Bros., the deal will be reviewed by the Justice Department, not the Federal Communications Commission (FCC), as WBD does not hold a TV license. The EU has consistently been a stickler for the strict regulation of large M&A deals that tighten market concentration.

In the U.S., at least two analysts – New Street Research’s Blair Levin and Doug Creutz of TD Securities – have reportedly said that the DoJ might challenge the merger and the deal would face multiple roadblocks. The fresh trading week may prove to be yet another interesting one, as investors chew on their popcorn amid more potential drama in Hollywood’s biggest disruption in decades.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<