Costco shares fell after a rare sell call, with concerns over slowing membership and a steep valuation.

- Roth cited slowing membership trends and rising competition despite strong results.

- Most Wall Street firms kept their ratings, leaving Roth as the lone post-earnings downgrade.

- Jim Cramer said Costco’s valuation leaves little room for missteps.

Costco stock slid toward its worst session in more than five months after Roth Capital downgraded the shares to ‘Sell’ from ‘Neutral’, calling the retailer’s valuation “concerning” and warning that membership momentum is slowing amid rising competition.

Roth cut its price target to $769 from $906, even after Costco reported a first-quarter (Q1) earnings beat. The firm pointed to fading renewal rates, slower growth in paid members, and decelerating year-over-year traffic, while flagging intensifying pressure from Walmart’s Sam’s Club and BJ’s Wholesale.

At the time of writing, Costco shares were down 3% at 858.36.

Wall Street Largely Holds Ground

Roth’s move was the only outright downgrade following earnings. Other firms mostly maintained their ratings while adjusting price targets. JPMorgan reiterated an ‘Overweight’ rating and raised its target, while Truist trimmed its target and kept a ‘Hold’. Baird, BMO Capital, Goldman Sachs, and Bernstein maintained bullish stances, retaining ‘Outperform’ or ‘Buy’ ratings, citing Costco’s value proposition, steady traffic, and resilient operating model.

Earnings And Membership Trends

Costco reported revenue and profit above Wall Street expectations, supported by solid comparable sales and strong digital momentum. Paid memberships rose just over 5% year over year, while renewal rates remained near 90% globally and above 92% in the U.S. and Canada. Some analysts, however, noted that growth in online sign-ups, particularly among younger members, has been accompanied by slightly slower renewal behavior.

Valuation Debate Intensifies

Jim Cramer added to the caution, saying Costco’s premium valuation leaves little room for error. Writing for CNBC, Cramer noted the stock trades at about 43 times forward earnings, well above the broader market, and warned that simply meeting expectations may no longer be enough to support such a multiple. He flagged softer renewal trends and management’s references to consumers being more “choiceful,” which he said he does not typically associate with Costco, while questioning whether comparisons with Walmart are becoming harder to ignore.

Broadcom Also Seen As ‘Battleground’ Stock

Cramer said Broadcom faces a similar challenge, describing it as another high-multiple stock where expectations leave little margin for disappointment. He said investor confidence was shaken after Broadcom disclosed that parts of its AI systems business carry lower margins due to pass-through costs, even as demand remains strong.

Cramer also pointed to uncertainty around the pace of AI data center buildouts tied to OpenAI and Oracle, saying questions about timing and profitability have turned Broadcom into a “battleground” stock. While he said he continues to trust Broadcom CEO Hock Tan and remains constructive on the company long term, Cramer warned that stocks trading at elevated valuations can come under sharp pressure when visibility becomes murky.

How Did Stocktwits Users React?

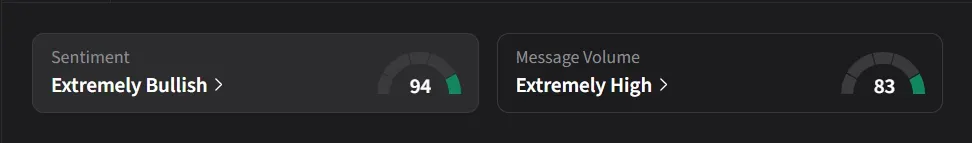

On Stocktwits, retail sentiment for Costco was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “no idea that ROTH CRAPITAL is now running the stock market now...interesting... lol”

Another user said, “Adding to the watchlist. Costco is the retail G.O.A.T”

Costco’s stock has declined 6.1% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<