Copper prices on the LME jumped 6.8% to $12,960/ton, before paring gains to trade about 2.3% higher at $12,398.5 a ton.

- Analysts have cautioned that copper prices may be overextended as demand slows in China.

- Spot prices (XCU/USD) fell 3.1% to $5.6 per pound on Monday morning.

- Southern Copper, Barrick Mining, and Freeport-McMoRan stocks traded lower premarket.

Copper surged to a fresh record close to $13,000 a ton in volatile trading on Monday, as the London Metal Exchange (LME) reopened after the Christmas holiday, extending a powerful year-end rally driven by tightening supply concerns.

LME Copper initially surged 6.8% to $12,960 a ton before settling around 2.3% higher at $12,398.5 a ton in London. Meanwhile, spot copper (XCU/USD) fell 3.1% to $5.60 per pound. The XCU/USD pair has gained more than 7% so far in December, and around 40% this year.

However, analysts have cautioned that copper prices may be overextended, particularly as demand slows in China, the world’s largest consumer.

“Some fabrication plants in China, which buy copper and are sensitive to prices, have cut production or even halted after the recent rally,” Wu Kunjin, head of base metals research at Minmetals Futures Co., told Bloomberg on Monday.

Goldman Sachs Remains Bullish

Goldman Sachs expects copper prices to consolidate in 2026 after a strong rally driven by tariff-related speculation. Prices climbed from around $10,600 a ton in November to $11,700 as traders anticipated higher shipments to the U.S. ahead of a potential tariff on refined copper, tightening supplies outside the country, Goldman said in its 2026 commodities outlook report published last week.

The firm noted that ex-U.S. inventories have become a better driver of LME prices in 2025 than global stockpiles, which have risen this year. The bank forecasts copper will average about $11,400 a ton in 2026, assuming tariff uncertainty persists until a mid-2026 announcement, with implementation pushed to 2027.

Goldman noted that while ex-U.S. inventories are expected to fall further, much of that decline is already priced into forward markets. Prices may ease in the second half of 2026 as the U.S. begins drawing down copper stockpiled over 2025-26, it said.

Despite near-term consolidation, Goldman continues to favor copper long term, citing strong demand from electrification, AI, power grids, and defense, alongside constrained mine supply.

How Did Stocktwits Users React?

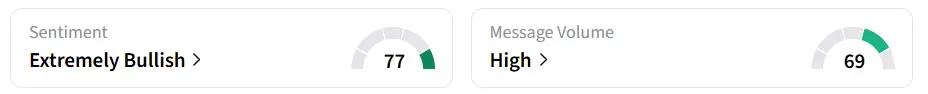

Retail sentiment for the United States Copper Index Fund (CPER) on Stocktwits remained ‘extremely bullish’ over the past 24 hours, amid ‘high’ message volumes.

Despite Southern Copper Corp.'s (SCCO) premarket decline, retail sentiment turned ‘extremely bullish’ from ‘bullish’ a day ago. Year-to-date, SCCO shares have gained nearly 70%, while the XCU/USD pair has climbed 22%.

Unplanned mine outages, trade policy uncertainties under President Donald Trump, and heavy pressure on global smelters have driven copper’s rally this year.

Read Also: Silver’s $80 Breach Sparks Strong Pullback, Miners Feel The Heat: HL, AG, PAAS Stocks Drop Premarket

For updates and corrections, email newsroom[at]stocktwits[dot]com.<