Ahead of its July 22 results, Colgate shares are hovering near a key support range of ₹2,260–₹2,350.

Colgate Palmolive shares tread cautiously ahead of its June quarter (Q1 FY26) results announcement on July 22. The stock is consolidating after a significant 37% fall from its all-time highs.

SEBI-registered analyst Rohit Mehta identified support between ₹2,260 – ₹2,350 for Colgate, with resistance at ₹2,944 and ₹3,818 (which was also its all-time high).

He observed that the stock was in a downtrend, with consolidation near a key support level. If Colgate manages to sustain above these levels, it could trigger an attempt at a reversal.

In terms of the shareholding pattern, the promoter's holding remained stable at 51% as of March 2025. Meanwhile, Foreign Institutional Investors (FIIs) reduced their stake from 23.72% to 22.23%, while Domestic Institutional Investors (DIIs) increased their holdings from 6.57% to 7.84%.

In its March quarter earnings, Colgate reported a 1.81% year-over-year (YoY) decline in sales, while operating profit fell 6.39%. Its profit before tax (PBT) also fell by 6.46%, and earnings per share (EPS) declined by 6.52% year-over-year (YoY).

Mehta highlighted that the company is virtually debt-free, strengthening its financial stability. It maintained a strong return on equity (ROE) of 72.4% over the last three years, indicating efficient capital utilization. Colgate has also consistently shown a robust dividend payout track record, averaging 106%.

On the other hand, he cautioned that the stock appears expensive, trading at 39.1 times its book value. Besides, it witnessed weak sales growth, with just 5.95% CAGR over the past 5 years.

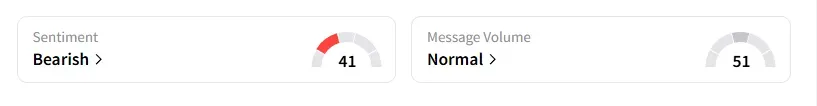

Data on Stocktwits shows retail sentiment turned ‘bearish’ a day ago on this counter.

Colgate shares have declined 10.5% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<