Coinbase shares rose in pre-market trading despite the company’s fourth-quarter earnings results falling short of Wall Street’s expectations.

- On the earnings call, CEO Brian Armstrong said the recent crypto market slump was not being driven by fundamentals.

- He added that some Coinbase users remain net buyers even after the decline in crypto prices since October.

- The company plans to use the dip to continue buying Bitcoin and repurchasing shares.

Coinbase Global (COIN) stock rose in early morning trade on Friday after CEO Brian Armstrong said the current slump in the cryptocurrency market was not due to fundamentals or macroeconomic factors, but rather a psychologically driven narrative.

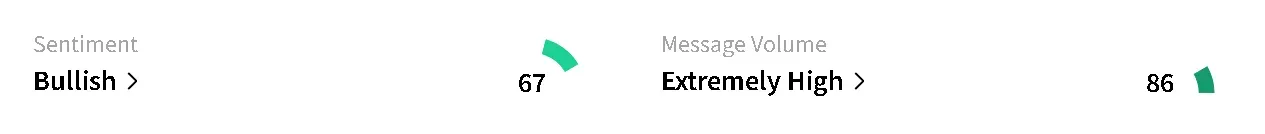

COIN’s stock gained more than 4.2% in pre-market trade following a near 8% drop ahead of earnings, and was among the top trending tickers on Stocktwits on Friday morning. Retail sentiment around the crypto exchange trended in ‘bullish’ territory as chatter rose to ‘extremely high’ from ‘high’ levels over the past day.

Meanwhile, Bitcoin’s price was trading at around $66,600, down 0.6% in the last 24 hours. Retail sentiment fell to ‘neutral’ from ‘bullish’ over the past day.

“There's a lot of Monday morning quarterbacking happening,” Armstrong said during Coinbase’s fourth quarter (Q4) earnings call. “I actually think markets are a little bit more like psychological things where people think someone else is going to think something, so they try to get ahead of it.”

Coinbase Earnings Fall Short Of Estimates

The company reported revenue of $1.78 million, missing analyst expectations of $1.83 million, according to Koyfin data. Earnings per share (EPS) also fell short of Wall Street estimates, coming in at $0.66 versus the expected $0.96.

Management said that while the crypto market cap fell 11% quarter over quarter, Coinbase outperformed the market in total trading volume, driven by strong derivatives volume growth. Armstrong added that the crypto exchange has doubled its trading volume and market share year-over-year.

Despite the early morning bump bump, some users on Stocktwits expect the stock to slide in Friday’s trade.

Armstrong Downplays Crypto Market Weakness

“I don't think this market correction is that connected to any fundamentals,” Armstrong said, stating that stablecoin adoption is continuing to grow and other indicators are also looking positive, including the fact that there are users on Coinbase who are still net buyers despite the drop in prices since October.

He reiterated his commitment to doubling down on the strategy of building through market downturns, framing the current crypto slump as an opportunity rather than a setback.

Armstrong was also among the crypto industry leaders appointed Thursday to the Commodity Futures Trading Commission’s (CFTC) Innovation Advisory Committee (IAC). The CFTC expanded the committee to nearly 35 members as part of a broader effort to engage industry leaders.

Read also: Bitcoin Unlikely to Deliver 500x Returns, Grayscale Chairman Says – But These 2 Privacy Tokens Could Outperform

For updates and corrections, email newsroom[at]stocktwits[dot]com.<