Traders pointing to the low post-merger float, technical setups, and comparisons to quantum peers as reasons for optimism heading into the NYSE debut.

- INFQ will become the first publicly listed neutral-atom quantum technology company.

- The merger preserved $551 million in gross proceeds due to minimal redemptions.

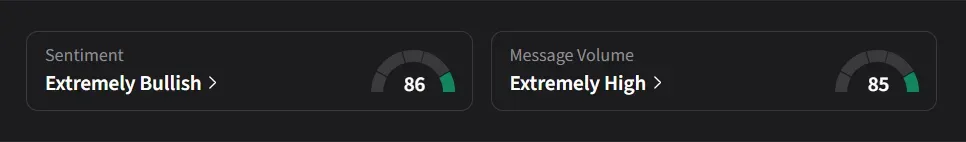

- Retail sentiment on Stocktwits has been ‘extremely bullish’ at its highest level this year.

Shares of Churchill Capital Corp X (CCCX) are set to begin trading under a new identity on Tuesday, after the special purpose acquisition company (SPAC) completed its merger with Infleqtion. The combined company is expected to start trading on the New York Stock Exchange under the ticker INFQ, with warrants listed as INFQ WS.

Merger Closes, NYSE Listing Set For Tuesday

Infleqtion completed its merger with Churchill Capital Corp X on Friday, becoming the first publicly listed neutral-atom quantum technology company, and the only public company with commercial operations spanning both quantum computing and precision sensing, according to the company.

Last week, Churchill shareholders approved all proposals tied to the merger at a February 12 extraordinary general meeting. Redemptions were limited to about 37,800 shares, or roughly 0.09% of shares outstanding, preserving most of the trust.

As a result, Infleqtion is expected to receive about $551 million in gross proceeds at closing, including roughly $425 million from the trust account and $126.5 million from a previously announced private placement. The unusually low redemption rate stood out in a SPAC market where many deals have struggled to retain capital.

Retail Sentiment Peaks Ahead Of NYSE Debut

On Stocktwits, retail sentiment around Churchill Capital Corp X (CCCX) was in ‘extremely bullish’ territory and has surged to its highest level so far this year (86/100) amid ‘extremely high’ levels of message volume.

Several users pointed to the expected post-merger share dynamics, with one trader saying it would be “great if they saved a couple good PRs for this week’s rollout on the NYSE,” adding that with “only ~40 million shares to trade for a month, it would be ideal to run it up.”

Others focused on prior price levels and upside potential. One user wrote, “don’t forget it was $18 just a few weeks ago. I would hope that we eclipse that and hold into the $20’s. Then new highs!!”

Another trader described the stock as “undervalued,” citing partnerships and patents and added, “whatever happens smart investors won’t sell they will buy more… Bullish AF.”

Technical traders highlighted chart setups ahead of the listing. One user said, “there’s no way to know for sure how a SPAC will unwind, but the chart looks like it is setting up well,” adding that reclaiming the 50-day moving average around $15.50 could open the door for further gains.

Several users also focused on the merger structure itself. One trader pointed to the unusually low redemption rate and the company’s investor materials, writing that the “released investor deck is impressive,” and that the revenue backlog stands out “as most SPAC’s are a concept and a pretty loose plan.”

More speculative chatter centered on potential post-listing announcements. One user claimed management “knows how WS [Wall Street] works,” adding, “I am positive they got some bomb press release ready post merger/IPO,” while another argued the market “has to value it higher than QBTS,” suggesting a valuation “which puts it at $35+.”

CCCX stock has risen 34% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<