AI slowdown fears, escalating U.S.-Iran tensions, and a range-bound move in Nvidia stock have kept many retail investors cautious and on the sidelines, as market sentiment remains mixed.

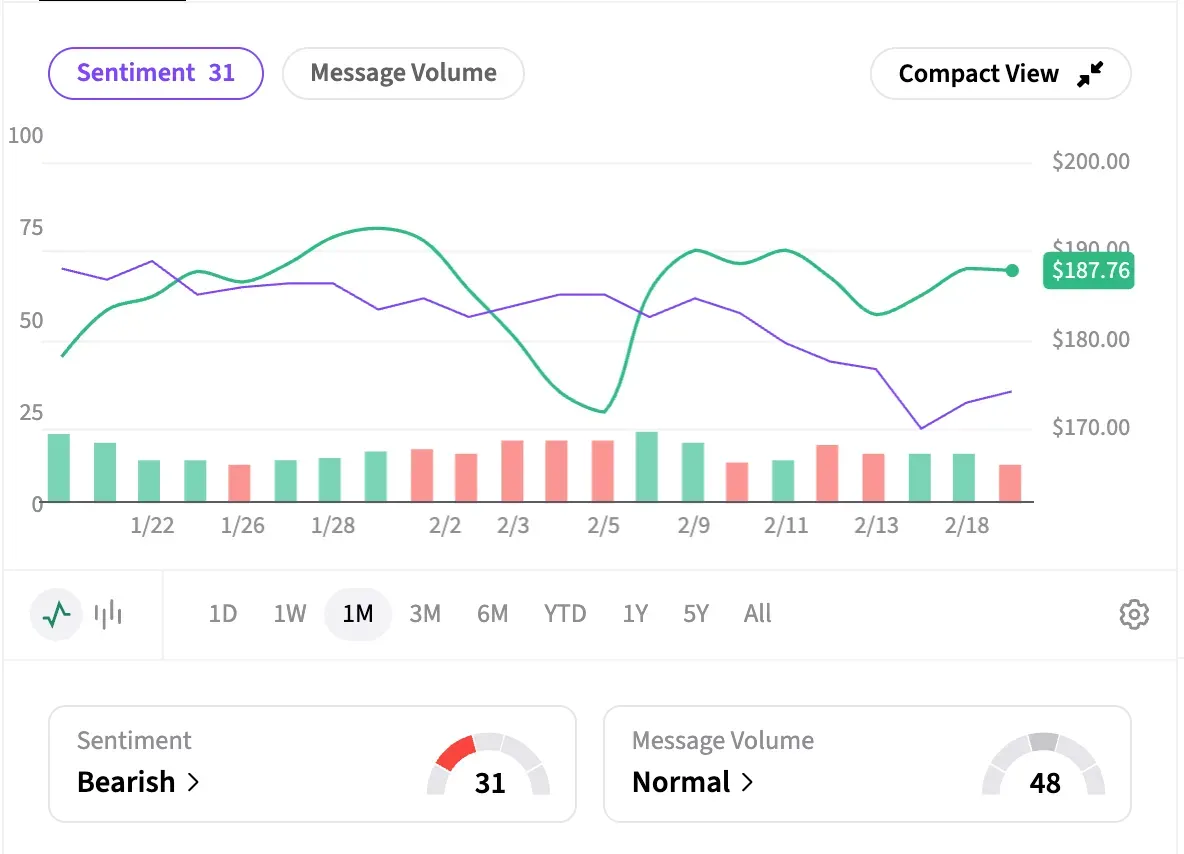

- Sentiment toward NVDA slid to ‘extremely bearish’ earlier this week before ticking up to ‘bearish’ as of the last close.

- Reports of potential U.S.–Iran escalation and broader market weakness have weighed on mega-cap tech.

- Nvidia is also finalizing a $30 billion investment in OpenAI, replacing the previously reported $100 billion deal, per Financial Times.

Sentiment toward Nvidia Corp. among retail traders has softened in recent weeks amid choppy trading, as investors fine-tune their positions ahead of the chip giant’s quarterly report next Wednesday.

Nvidia’s earnings have become a marquee quarterly event, shaping investor sentiment around artificial intelligence (AI) and the broader tech sector. Over the past year, worries about heavy capital spending, stretched valuations, and potentially moderating AI returns have periodically rattled markets – they triggered a sharp correction in November – even as Nvidia has continued to deliver successive blowout results, underscoring that AI demand remains robust.

On Stocktwits, retail sentiment for NVDA has declined over the past two weeks. It dipped to ‘extremely bearish’ on Tuesday before shifting a notch higher to ‘bearish’ as of late Thursday. Nvidia shares have traded with a range in the new year, but fell sharply early this month amid another market selloff linked to AI.

Message volume for the ticker fell 42% in the past 30 days.

US-Iran Escalation Weighs on Market

On Thursday, reports indicated an escalation between the U.S. and Iran, with CNN reporting that the U.S. military is prepared to strike Iran if Tehran does not commit to winding down its nuclear program. The development appears to be pressuring markets – the S&P 500 index declined 0.3% on Thursday – and weighing on the sentiment for big stocks such as Nvidia.

Meanwhile, Nvidia is close to finalizing a $30 billion investment in OpenAI, The Financial Times reported, weeks after speculation about a potential rift between the two sides and the shelving of an earlier $100 billion investment plan. Those rumours, although denied by the respective companies, hammered Nvidia shares in early February.

“I guess that the current weaknesses of the stock stems from the lack of momentum, as stock volumes are weak,” a Stocktwits user posted, adding that it should fade by next week.

Another called it "manipulation" by whale investors. “It's like a roller coaster,” they said. Overall, the commentary was broadly upbeat, with several pointing to hefty capex plans by Big Tech cloud players as the clearest signal of sustained support for Nvidia.

Analysts’ View

Nvidia is set for a “solid” earnings quarter, driven by backlog growth and the Rubin GPU ramp, RBC Capital Markets. While higher memory prices could pressure margins, analysts say multi-year supply deals, pricing power, and potential Samsung Electronics entry into HBM4 should help offset risks, according to the investment research firm.

Analysts expect Nvidia’s fourth-quarter revenue to rise 67% to $65.69 billion – the highest pace in the last three quarters – and adjusted earnings to increase to 71% to $1.53 per share. Fifty-six of 61 rate the stock ‘Buy’ or higher with an estimated upside of 35%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<