A SEBI analyst believes that ICICI Bank is poised for gains, as current technical charts indicate a bullish momentum. He sets a target above ₹1,500.

ICICI Bank has emerged as a strong performer in the current earnings season, with its stock showing notable resilience. Its stock has gained 5% in the last five sessions.

The boost came from the Reserve Bank of India this week after the central bank eased Liquidity Coverage Ratio norms, giving banks more flexibility in managing their funds.

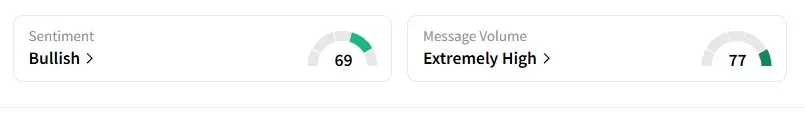

Data from Stocktwits India indicates retail sentiment remains ‘bullish,’ with ‘extremely high’ message volumes.

SEBI-registered analyst Prabhat Mittal said on Stocktwits India that following its quarterly results, the stock formed a parallel channel pattern on the short-term chart — indicating a period of consolidation and stability amid broader volatility.

A recent breakout from this channel, marked by a green trendline in the chart, signals renewed bullish momentum.

Mittal believes that from a technical standpoint, ICICI Bank is displaying strength across multiple indicators.

The stock is trading above its 20-day, 50-day, 100-day, and 200-day moving averages, reflecting sustained upward momentum over short, medium, and long-term periods.

Additionally, the MACD (12,26) crossover is flashing a fresh buy signal, further reinforcing the bullish case.

The MACD is a line on a trading chart that shows the difference between a stock’s short-term and long-term average prices, helping traders spot whether the price is gaining or losing momentum.

Given these indicators, Mittal recommends a short-term buy on ICICI Bank.

According to him, traders can consider entering the stock between ₹1,360 and ₹1,400, with a stop loss at ₹1,335.

The short-term upside potential for ICICI Bank is pegged at ₹1,500–₹1,520.

ICICI Bank's stock has gained 11% year-to-date (YTD)

For updates and corrections, email newsroom[at]stocktwits[dot]com.<